Do you want to compare the best stocks & shares ISAs but find it difficult to find a complete overview of the choices available? Frustrated by price comparison websites only featuring a handful of stocks & shares ISAs based on advertising relationships? This article is the solution, featuring full list of stocks & shares ISA providers available to UK investors. Read our article on who can open a stocks & shares ISA to understand if you qualify.

How we compiled this list of stocks & shares ISA providers

Please help us to keep this list up to date by leaving a comment below if you find a provider which we haven’t included in this list.

This list is in no particular order, and we have not reviewed or performed due diligence on the stocks & shares ISA providers below. We have collated this list through Google searches, top-picks lists and industry newsletters.

Please perform your own research before making an investment. Financial Expert does not provide financial advice.

Which are the best stocks & shares ISAs?

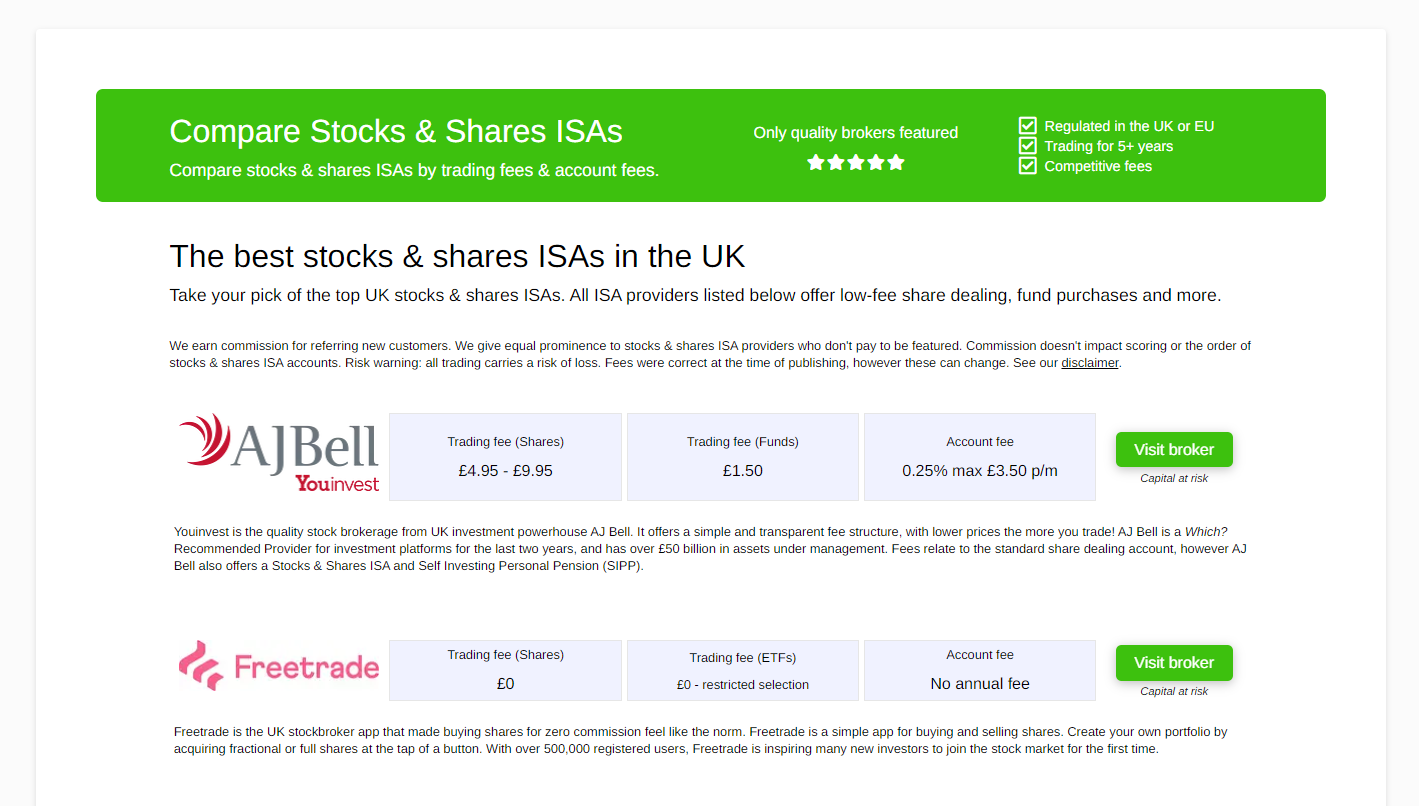

We’ve shortlisted the best of the best stocks & shares ISAs below to help your search:

Large UK trading platform with a flat account fee and a free trade every month. Cheapest for investors with big pots.

The UK’s no. 1 investment platform for private investors. Boasting over £135bn in assets under administration and over 1.5m active clients. Best for funds.

Youinvest stocks & shares ISA offers lower prices the more you trade! Which? 'Recommended Provider' for last 3 years.

Buy and sell funds at nil cost with Fidelity International, plus simple £10 trading fees for stocks & shares and ETFs.

Capital is at risk

Please also see our Hargreaves Lansdown review, our AJ Bell review and interactive investor review.

A list of all stocks & shares ISA providers:

The major banks & building societies

Banks are often the first port-of-call for savers who are looking to do more with their money than used a cash ISA, instant access account or fixed-term savings bond.

Most high-street banks offer restricted financial advice in-person. With this service, you can book an appointment to discuss the banks range of investment accounts and understand the key features of each. This is not the same as independent financial advice.

An independent financial adviser (IFA) is able to search the whole of the market to recommend the most suitable financial product for you, whereas a restricted adviser may only be able to discuss and recommend the selection of products offered by the bank alone. Some banks do offer independent financial advice, however the fee for this will be higher than restricted advice.

This can still be a helpful way to learn more about stocks and shares ISAs in general. You could ask about what type of investments can be held in a stocks & shares ISA, whether stocks and shares ISAs are risky, and learn more about the fees and charges of a stocks & shares ISA.

Banks tend to offer a reasonable service but at a cost. Their trading fees tend to be higher than other specialist providers who compete for business primarily on investment costs. Because banks can cross sell their investment ISAs to their existing customer base, they don’t need to compete as fiercely on platform fees and trading fees as a result.

Read more: The best banking books

Natwest – https://personal.natwest.com/personal/investments/natwest-invest.html

RBS – https://personal.rbs.co.uk/personal/investments/royal-bank-invest.html

Barclays Investor – https://www.barclays.co.uk/smart-investor/accounts/investment-isa/

HSBC – https://www.hsbc.co.uk/investments/isas/

Santander – https://www.santander.co.uk/personal/savings-and-investments/investments/stocks-and-shares-isa

Halifax – https://www.halifax.co.uk/investing/start-investing/share-dealing-services/stocks-and-shares-isa.html

Lloyds Bank – https://www.lloydsbank.com/investing/ways-to-invest/share-dealing-services/share-dealing-isa.html

Nationwide Building Society – https://www.nationwide.co.uk/products/savings/stocks-and-shares-isas

Skipton Building Society – https://www.skipton.co.uk/savings/isas/stocks-and-shares-isas

Scottish Friendly – https://www.scottishfriendly.co.uk/isas/my-choice-isa

Shepherds Friendly – https://www.shepherdsfriendly.co.uk/stocks-and-shares-isa/

Virgin Money – https://uk.virginmoney.com/virgin/isa/stocks-and-shares/

Coutts – https://www.coutts.com/online-investing.html

Bank of Scotland – https://www.bankofscotland.co.uk/investing/ways-to-invest/share-dealing-services/stocks-and-shares-isa.html

JP Morgan – https://am.jpmorgan.com/gb/en/asset-management/per/investment-themes/isa-investments/

The major life assurers

It may surprise you to learn that the major UK life assurers also offer stocks & shares ISA. This is because the life assurers are principally in the business of wealth management. Read more: The best wealth management books.

Life assurers manage billions of pounds of pension schemes and invest the insurance policy premiums received on policies. They have evolved to become one-stop-shops for financial and retirement planning. Offering life insurance, pensions and investment accounts. Please note that some of the assurers ‘outsource’ the administration aspects of stockbroking to another firm.

Life assurers also tend to open new accounts by cross-selling to existing customers, or having clients referred by financial advisers. Therefore, like the major banks, they don’t have the incentive to drive down investing costs.

Aviva – https://www.aviva.co.uk/investments/stocks-and-shares-isa/

Standard Life / Aberdeen – https://www.standardlife.co.uk/isa

Aegon – https://www.aegon.co.uk/personal/products/stocks-and-shares-isa.html

Prudential – https://www.pru.co.uk/existing-customers/products/isa/

Legal & General – https://www.legalandgeneral.com/investments/stocks-and-shares-isa/

The major stockbroking & wealth management firms

Of course, the largest players in the stocks & shares ISA market are the stockbroking firms, which offer ISAs alongside their standard investment accounts. For investors with more to invest, it’s common to open an ISA and a non-ISA. Investors will initially deposit into the ISA until they’ve fully used the annual ISA allowance and then further deposits in that tax year will go into the non-ISA.

Read more: Compare the best stockbrokers

Hargreaves Lansdown – https://www.hl.co.uk/investment-services/isa

Fidelity International – https://www.fidelity.co.uk/stocks-and-shares-isa/

Vanguard – https://www.vanguardinvestor.co.uk/investing-explained/stocks-shares-isa

Charles Stanley Direct – https://www.charles-stanley-direct.co.uk/Our_Services/ISA/

Interactive Investor – https://www.ii.co.uk/ii-accounts/isa

AJ Bell YouInvest – https://www.youinvest.co.uk/isa

IG Share Dealing ISA – https://www.ig.com/uk/investments/isa/share-dealing

Other stocks & share ISA providers:

Other stocks & shares providers include foreign banks, and small investment services which have appeared in the last ten years. When investing with a company you haven’t heard of before, it’s extra important to conduct good due diligence on the company to help avoid investment scams.

Read more: The best due diligence books.

Evestor – https://www.evestor.co.uk/isa

BMO (Bank of Montreal) – https://www.bmogam.com/gb-en/retail/plans-explained/isa/

Wesleyan – https://www2.wesleyan.co.uk/savings-and-investments/with-profits-isa

Triodos Bank – https://www.triodos.co.uk/ethical-isas

True Potential Investor – https://www.tpinvestor.com/stocks-shares-isa

Redmayne – https://www.redmayne.co.uk/isas

M&G – https://www.mandg.com/investments/private-investor/en-gb/investing-with-mandg/our-products/isas

EQ Shareview -https://www.shareview.co.uk/4/Info/Portfolio/default/en/home/products/Pages/Buyandsellshares.aspx

iWeb – https://www.iweb-sharedealing.co.uk/our-accounts/self-select-stocks-and-shares-isa.html

Sharedeal Active – https://www.sharedealactive.co.uk/isa-account.html

Managed investment stocks & shares ISA providers:

The following ISA providers allow clients to automate their investment experience within the ISA tax wrapper. The opposite of a ‘DIY’ investing approach – these providers don’t allow clients to pick individual stocks and shares to invest in. Instead, you can choose an overall risk level or investing approach, and their investment team will handle the rest.

These platforms carry higher platform charges that DIY online share dealing services, but in exchange for that extra 0.2 – 0.5% fee you are saving the huge time and effort that some DIY investors need to spend to manage their portfolios.

For those who don’t know what to invest in, and don’t want to have to pick the best companies or best funds to invest their money in, managed services can feel like a relief.

Nutmeg – https://www.nutmeg.com/isas

Wealthify – https://www.wealthify.com/isa

Wealthsimple – https://www.wealthsimple.com/en-gb/learn/what-is-isa

Moneyfarm – https://www.moneyfarm.com/uk/isa/

Moneybox – https://www.moneyboxapp.com/isa/

Everything you need to know about stocks & shares ISAs

- What is a stocks & shares ISA?

- What investments can be held in a stocks & shares ISA?

- How to become a stocks & shares ISA millionaire

- The history of stocks & shares ISAs

- Who can open a stocks & shares ISA?

- What is the minimum amount needed to open a stocks & shares ISA?

- Are stocks & shares ISAs only available in the UK?

- Full list of stocks & shares ISA providers

- How risky are stocks & shares ISAs?

- What fees do stocks & shares ISA accounts charge?

- What is the current stocks & shares ISA allowance?

- Are stocks & shares ISAs tax free?

- Do you need to disclose income and gains in stocks & shares ISA on your tax return?

- What happens to a stocks & shares ISA when I die?

- Stockbroker reviews (UK)

Comments 1

Good luck