We have performed original research across the UK stockbroker market to compare and contrast the number of accounts offered by the leading players in the industry. Use this guide to see at a glance, whether your favoured UK stockbroker offers the account you’re seeking.

eToro keeps it simple with two accounts

eToro offers two types of accounts on its website.

- Standard

- ISA (provided in partnership with Moneyfarm, (as reported in our April 2023 stockbroker bulletin)

eToro’s standard account is potentially two services in one – depending on who you are, where you live and whether you meet their standards for financial education and investing risk profile.

All investors can trade stocks and use the CopyPortfolio /Copy Trader service.

Eligible investors can trade Contracts for Difference; a high-risk product that may not be suitable for all.

Charles Stanley broadens horizons with four accounts

Charles Stanley Direct is the broker’s retail investor offering. Four accounts are available for you to apply to today:

- Investment account

- Stocks & shares ISA

- Junior stocks & shares ISA

- SIPP

Like many brokers, Charles Stanley has chosen to eschew the Lifetime ISA. For many providers, this oft-criticised and unpopular product has not gained enough traction with the public to justify the administration costs to mid-sized brokers.

Charles Stanley’s stocks & shares ISA account comes with three distinct levels of autonomy for investors:

- Discretionary management (minimum account size £200,000)

- Foundation portfolio (minimum account size £20,000)

- DIY investing (No minimum)

So for wealthier savers who wish to enjoy the dedicated oversight of a named representative, or a young investor looking to actively buy shares, this single account type actually serves both purposes.

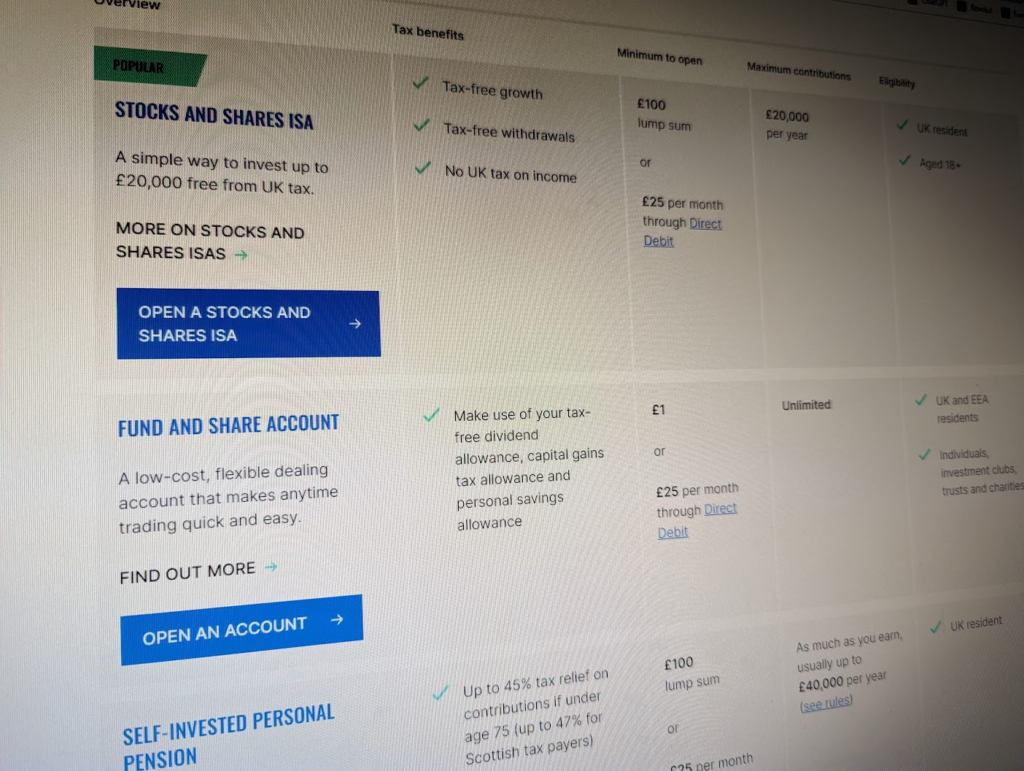

Brewin Dolphin empowers investors with four account types

Brewin Dolphin offers a more premium, managed experience for clients, and therefore most of its accounts come with advice or managed portfolios. Therefore we’ll provide a bit more context to allow you to compare these account and service types. We won’t include its higher-end wealth management services as these are not comparable to the typical UK stockbroker fare and are not online-focused.

- Brewin Portfolio Service – Apply online to invest in pre-made model portfolios for a 0.7% annual service fee, and underlying fund management fees ranging from 0.07% to 0.72% annually.

- WealthPilot managed portfolio service – Simple financial advice service with free upfront consultation, followed by a 0.75% annual advice fee, and 0.2% underlying fund management charge.

Brewin differs from many UK stockbrokers in offering two routes for investing on behalf of children;

- Junior Investment ISA

- Bare Trust Account

A bare trust account is like a general investment account that can be opened by anyone on behalf of a child. A bare trust account doesn’t come with many of the strings that might tie up someone considering a junior isa; the account needn’t be opened by a parent, and there are no contribution limits. Also, cash can be withdrawn at any time rather than being locked away until the child reaches a certain age.

AJ Bell impresses with its range of six accounts

AJ Bell’s website allows you to open six different account types:

- Standard dealing account

- Stocks & shares ISA

- Lifetime ISA

- Self-Invested Personal Pension (SIPP)

- Junior ISA

- Cash savings hub

Its cash savings hub is a dedicated account allowing you to earn a higher yield on your cash savings than as uninvested cash within AJ Bell’s investment accounts. It’s designed as a replacement for your existing cash savings than as a more efficient way to stash your loose trading change though. The hub acts as a low-friction intermediary, to facilitate you opening accounts with savings institutions and takes the paperwork out of switching.

The cash savings hub isn’t a tax-shielded account like a cash ISA, so you may be liable to income tax on any interest you earn above the personal savings allowance.

The cash hub offers access to foreign institutions that may be offering a better rate, such as at the time of writing the National Bank of Egypt is top of the hub’s table for 9-month fixed term deposit accounts. Up to £85,000 of cash saved with each bank through the hub is protected through the FSCS scheme.

interactive investor includes rare options in its range of six accounts

interactive investor

- Trading

- ISA

- SIPP

- Junior ISA

- Joint Trading Account

- Company Account

The joint trading account and company account offered by ii are rare types of accounts.

The joint account is open to any pairing of 18+ adults living in the UK. The two individuals needn’t be married or even in a romantic relationship.

A company account allows a UK Limited Liability Company (limited by shares) to open an account in the name of the corporate body. At the account setup stage, a nominated contact will be identified who will have permission to access the account and enter into trades. Authorisation of a Company Director is necessary to ensure that ii has established that the nominee has sufficient authority to act on the company’s behalf.

Entrepreneurs should know that buying shares could have tax implications for their companies. If the size of investments or the income derived from them becomes too large in proportion to the ordinary trade of the business, HMRC may conclude that the company is now an ‘investment company’, which follows different tax rules. The negative impact of these rules on how company trade is taxed may offset the benefits of higher returns generated by investing cash. Therefore we recommend seeking professional tax advice before making investments through a company account.

Hargreaves Lansdown leads the pack with over eight brokerage accounts

It may not surprise you to learn that the largest UK broker also offers the widest range of accounts. Hargreaves tops this listing by offering a total of eight separate account types to new customers. These are:

- General investment account, which it calls a ‘Fund and Share’ account

- Stocks & shares ISA

- Lifetime ISA

- Junior ISA

- Junior SIPP

- SIPP

- Active Savings

- Cash ISA

This effectively represents the full complement of tax-shielded accounts possible.

The first six accounts in this list can all hold a similar range of investments, such as cash, funds, individual shares and ETFs. However, each comes with its own eligibility criteria, deposit restrictions and tax advantages.

While Hargreaves has the longest account list, it doesn’t include a dedicated joint account. That’s because HL allows users to apply jointly to a number of their accounts, and therefore does not list this as a separate offering.

It is unclear whether Hargreaves continues to offer Share & Fund accounts to companies. A help page still exists that refers to the account, although references to it are absent from the rest of the website, and the application form for a Fund & Share account appears to offer no clear way to apply on behalf of a corporate entity.

Are more account types necessarily better?

Now that we’ve compared the leading UK brokers by number of accounts, let’s discuss how account range impacts your satisfaction and cost as an investor. Here are some points to consider:

Minimal administration

If you value your time and expect to use many different investment accounts, it can be convenient to consolidate them within a single broker. This way, you’ll reduce the number of broker relationships you hold. A single call with one institution will be all you need to do to ask questions or authorise transactions for each investment account you own.

Transferring cash between accounts is also a doddle when moving between accounts held with the same provider. This is often faster than transferring between institutions and naturally is much more secure. If you’re selling shares in a general investment account, to move into your ISA then you’ll spend less time out of the market when transferring internally.

Single-log in

Stockbrokers will present you with a summary of all of your different accounts at a glance, making it simple and quick to take stock of your wealth and update any regular budget you manage.

This is preferential to having to log into 3 – 5 different investment platforms every time you want to take a reading of how well your investments have performed overall.

Consolidated portfolio analysis

Some platforms will even provide some investment analysis (such as sector tilt, asset class or style tilt) at the account level rather than by account. This can provide useful insights into your true allocation to cash, bonds and stocks in totality rather than needing to crunch a lot of data to calculate this yourself.

Some accounts are more competitive than others

Account fees often vary by account type, meaning that your total service fees will likely be a blend of the fees charged on each of your accounts held with a provider. Therefore, it’s important to compare accounts in their own right to conclude whether they are market-leading.

No stockbroker beats the market on every front. Therefore, if you have a broad range of accounts with a single institution, it’s very likely that you’re being underserved or overcharged for at least one of your accounts, compared to another broker.

Assessing how much you value your time, against the £ cost saving you might realise from switching, means that there is no one correct answer to the question of whether using multiple brokers is advisable.