Putting shares in your stocks and shares ISA requires some confidence.

I mean, what are shares if not a test of your faith in the economy? In contrast, commodities are real, tangible objects. They’re solid assets that you can touch with your bare hands. But does that make commodities a safe investment?

This short article expands upon my guide on how to invest in commodities by looking carefully at the properties of a commodity investment. Do commodities preserve value more effective than investing alternatives? Read on to find out.

The best books about commodities will also provide excellent detail on all the topics we touch upon below.

Do investors actually want safety?

In the financial markets, investors are rewarded for the risks they take.

This isn’t because some benevolent leaders decide to be kind. It’s inevitable. No investor would ever buy a risky asset if it wasn’t priced low enough to give them a good return and fair compensation for potential losses.

The theory

Old and new finance theories back this up. A well-known model called the ‘CAPM’ pricing theory, states that the expected return of an investment can be calculated as

Risk-free rate + (Market risk premium x Risk of investment relative to the market)

Definitions:

Risk-Free Rate = Yield on safe government bonds, so about 2%

Market Risk Premium = Average return on shares above the risk-free return, so about 5%

Risk of investment relative to market = 1 if your investments are as volatile as the average stock, above that if it’s riskier, and less e.g. 0.5 if the stock is less risky.

Example:

Therefore if you buy an investment that is about 1.5 times more volatile (risky) than the average investment, your expected return is = 2% + 5%*1.5 = 10.5%

The takeaway

What can we draw from this? We can conclude that the financial markets will not reward any investor generous for holding a ‘safe’ investment, i.e. one that is not exposed to normal market risks.

The risk-free rate is all you can expect to receive if your capital and income is guaranteed.

If you want to see growth in your investment, you will need to aim for risky investments.

How safe are investments in commodities?

I’ll define ‘safe’ in 3 ways, then apply each test to commodities. This objective assessment of commodity risk might help you decide what to invest in.

- Low volatility

- Protection from capital losses

- Unlikely to fall sharply during a market crash

So how do commodities stack up against these 3 definitions?

Do commodities offer low volatility?

Commodities fail the low volatility test.

In terms of day-to-day price movements, commodities are actually worse than company shares.

First of all, they’re usually priced in a foreign currency, which means both the value of the currency (usually USD) and the underlying price of the asset contribute towards the volatility.

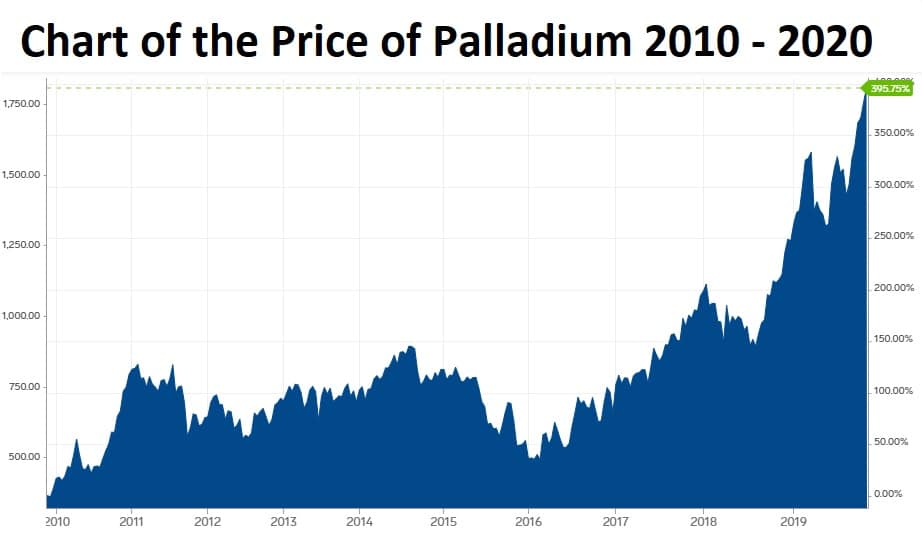

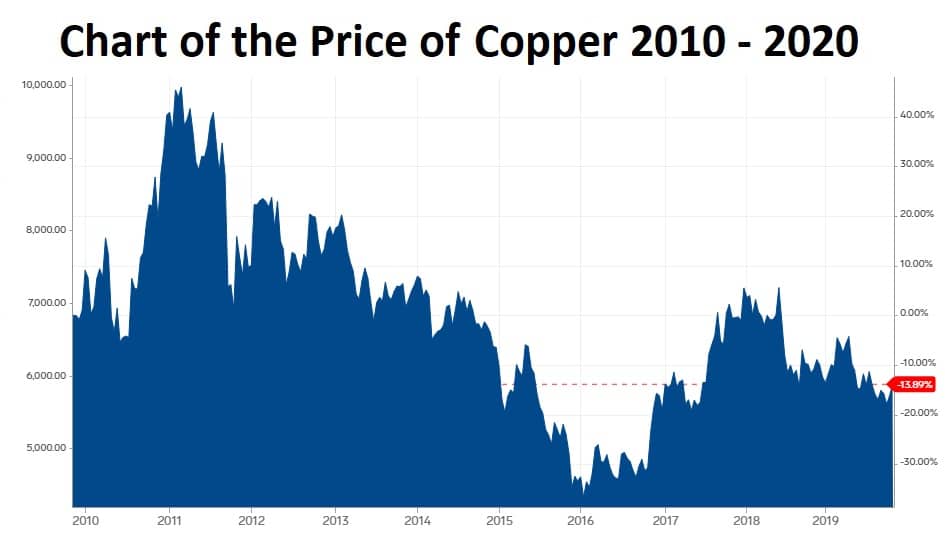

Commodities have shown exceptional volatility throughout history, and their performance is not improving.

Consider that the original purpose of financial instruments such as ‘forward contracts’ and ‘options’ was to allow producers to remove some of the pricing risk by locking in prices upfront. The fact that these contracts were needed speaks volumes about the price risk these producers face.

Do commodities offer capital protection?

The high volatility of commodities removes any prospect of capital protection. A 2010 investor in copper would have lost half of their investment after five years.

Here’s another interesting example: an investor who bought gold in 1980 would still not have recovered the purchasing power of their original investment by the current day – such was the scale of its price crash in the years that followed.

Read more: The best gold & silver books

I believe that any commodities ability to hold value is heavily reliant upon the timing of the purchase, and what factors supported the price at the time.

Price surges tend to be the temporary result of real-world factors such as poor harvests, climate disasters and warfare. This means that any significant gains are likely to reverse at some later date as these factors ease.

Do commodities buck the downward trend in a financial crisis?

This definition of safety is perhaps the saving grace of commodities.

While their value fluctuates on a day-to-day basis, they tend to keep their value in hard times.

Why? Because this is the market consensus.

When recessionary fears kick in, nervous investors move their money to asset classes seen as ‘safe havens’ in anticipation of falls in the value of other assets such as shares and property investments.

Speculators who understand this relationship, also make purchases which further moves prices.

Taken together, this chain of events almost guarantees that certain precious metals, such as gold, will perform strongly. This is despite the fact that their real world purchasers (such as jewellers) might be scaling back their purchase orders.

In conclusion, are commodities safe investments?

I personally don’t believe that a barrel of black liquid is ‘safer’ than a bank.

We should try to avoid our gut instincts (which prefers the ‘tangible) when investing. Let’s not forget that shareholders of companies are also buying ‘real assets’, such as buildings, equipment and employees.

For 2 out of 3 of our definitions of ‘safe’, commodities failed the test.

However, the herd effect as capital flies to ‘safe havens’ during a financial storm can mean that precious metals like gold move in the opposite direction to shares during a market crash.

It might not be ‘safe’, but it’s certainly a helpful characteristic which you will value if the stock index falls by 30%!