Last updated: 20 December 2021. This page hosts my ranking of the 5 best derivatives books available in 2022. I've also created a couple of other shortlists of interesting or specialist derivative titles which may be of interest. I hope you find this helpful. The way I group and filter these titles should save you a lot of searching and researching at your local book store or online.

The best derivatives books tend to cater towards two audiences:

Derivatives books for beginners to the world of derivatives. These feature introductory chapters which explain how each commonly traded financial instrument works, and how its price behaves.

- Call & put options

- Futures and forwards

- Swaps, such as credit default swaps or interest swaps

The best derivative books aimed at beginners will include some practical examples of how hedge funds, businesses or banks use these derivatives to take on, or to manage away specific risks.

Derivatives books for finance professionals. These books tend to specialise in groups of derivatives with similar characteristics. This allows the author to provide a far richer and deeper look at the many ways in which derivatives can be effectively (or ineffectively) used.

Such books are perfect for those who work in finance to develop their understanding of these instruments which Warren Buffett once referred to as 'weapons of mass destruction.' While I whole-heartedly disagree with that characterisation, I do like to use the quote to remind me that derivatives by their very nature need to be handily very carefully. Derivatives are often inherently leveraged and can produce unforeseen or unwanted results in quite spectacular fashion if entered into improperly.

All books featured are beginner friendly and don't assume much prior knowledge. With prices ranging from £5 - £25, stocking up on a few of the best investing books can deliver the same value as an expensive seminar for only a fraction of the cost. They can even be read for free with Amazon's Kindle Unlimited free trial.

Click on any title below to see the latest price from Amazon, you'll be shocked at how affordable the most popular titles are. As an Amazon Associate, I earn a small commission from qualifying purchases which helps to support this site. This does not impact how I compile the list. Happy reading!

Discover prime books on investing and finance

No boundaries, just your curiosity- Invest with confidence

- Finance industries

- Real estate & real assets

- Exotic investments

- The bigger picture

Books reviewed

Financial Expert 2024 Book Awards

Gold Prize

Financial Times Guides: Investing by Glen Arnold

Derivatives books for finance professionals or students

Become an expert of the detail, execute with mastery.Derivatives books written by insiders or journalists

Salacious and entertaining titles from bankers and beyondDownload all these derivatives books for free with Kindle Unlimited

You DON'T even need a Kindle device to download booksHere's a useful tip that will save you £100+ on derivatives books. Sign-up to Amazon's Kindle Unlimited free trial, which offers access to all titles for free for 30 days.

- There's no obligation to continue with a paid subscription.

- You don't even need a Kindle to enjoy - any device will do.

If you're cost-savvy, you'll already be calculating the savings you could unlock and the knowledge you could gain by downloading 5 books over the next 30 days.

My Top 5 Derivatives Books for 2022

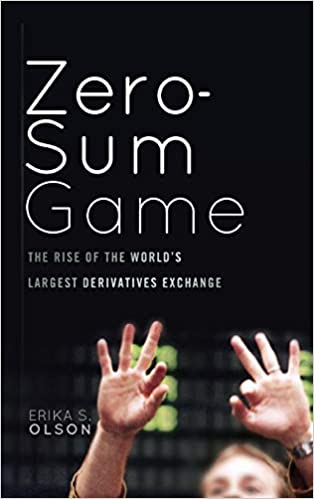

Click covers to see latest reviews and prices1. Options, Futures and Other Derivatives - John Hull

Financial Expert Rating:

Synopsis:

"Practitioners refer to it as “the bible;” in the university and college marketplace it’s the best seller; and now it’s been revised and updated to cover the industry’s hottest topics and the most up-to-date material on new regulations.

Options, Futures, and Other Derivatives by John C. Hull bridges the gap between theory and practice by providing a current look at the industry, a careful balance of mathematical sophistication, and an outstanding ancillary package that makes it accessible to a wide audience.

Through its coverage of important topics such as the securitisation and the credit crisis, the overnight indexed swap, the Black-Scholes-Merton formulas, and the way commodity prices are modeled and commodity derivatives valued, it helps students and practitioners alike keep up with the fast pace of change in today’s derivatives markets."

Who this book is for:

Known by industry insiders as simply 'Hull', Options, Future and Other Derivatives is the textbook for students or finance professionals learning about derivatives.

This text is remarkable for its sheer breadth - with content pages that stretch out for miles.

If you have a question about derivatives, it's likely to be covered!

What other academic or technical textbooks carry 79% 5-star reviews? Find out why by ordering a copy today. I suggest a paperback to save costs.

Financial Expert Rating:

Synopsis:

"Trading and Pricing Financial Derivatives is an introduction to the world of futures, options, and swaps. Self-study investors who are interested in deepening their knowledge of derivatives of all kinds will find this book to be an invaluable resource.

The authors delve into the history of options pricing; simple strategies of options trading; binomial tree valuation; Black-Scholes option valuation; option sensitivities; risk management and interest rate swaps in this immensely informative yet easy to comprehend work.

Using their vast working experience in the financial markets at international investment banks and hedge funds since the late 1990s and teaching derivatives and investment courses at the Master's level, Patrick Boyle and Jesse McDougall put forth their knowledge and expertise in clearly explained concepts. This book does not presuppose advanced mathematical knowledge and is designed for a general audience, suitable for beginners through to those with intermediate knowledge."

Who this book is for:

An interesting fact that many people don't know about author Patrick Boyle, is that he has a fantastic YouTube channel in which he explains basic derivative concepts.

If you're after more - more detail, more examples, and more derivatives, then consider buying his affordably priced book Trading and Pricing Financial Derivatives.

Financial Expert Rating:

Synopsis:

"All About Derivatives, Second Edition, presents the complex subject of financial derivatives with a clarity and coherence you won’t find in other books.

Using real-world examples and simple language, it lucidly illustrates what derivatives are and why they are so powerful. This second edition of All About Derivatives provides a rock-solid foundation on:"

Who this book is for:

A book for derivative beginners, All About Derivatives is the perfect first book about derivatives.

I would have included higher in this list, were it not for the fact that the majority of derivative book users are not beginners.

It's an excellent example of how to convey complex ideas in a simple and easy way to understand.

A great buy for any student, investors or finance professional looking to delve into derivatives for the first time.

Financial Expert Rating:

Synopsis:

"Derivatives Essentials is an accessible, yet detailed guide to derivative securities. With an emphasis on mechanisms over formulas, this book promotes a greater understanding of the topic in a straightforward manner, using plain-English explanations.

Mathematics are included, but the focus is on comprehension and the issues that matter most to practitioners—including the rights and obligations, terms and conventions, opportunities and exposures, trading, motivation, sensitivities, pricing, and valuation of each product."

Who this book is for:

Derivatives Essentials is the title for you if you're looking for intermediate level content in the derivatives space.

Expect to find the following detail about most major classes of derivative:

- Understand the concepts behind derivative securities

- Delve into the nature, pricing, and offset of sensitivities

- Learn how different products are priced and valued

- Examine trading strategies and practical examples for each product

Financial Expert Rating:

Synopsis:

"FX Derivatives Trader School is the definitive guide to the technical and practical knowledge required for successful foreign exchange derivatives trading. Accessible in style and comprehensive in coverage, the book guides the reader through both basic and advanced derivative pricing and risk management topics.

The basics of financial markets and trading are covered, plus practical derivatives mathematics is introduced with reference to real-world trading and risk management. Derivative contracts are covered in detail from a trader's perspective using risk profiles and pricing under different derivative models."

Who this book is for:

The best selling derivatives book in the foreign-exchange sphere.

FX Derivatives Trader School is ranked 4.5/5.0 on Amazon, and it's easy to see why.

Its has the right blend of maths, concepts and illustrations to give a balanced way to approach this heavy topics for a wider range of readers.

The Financial Expert™ Best Derivatives Book Challenge

I challenge you to read one book per month and see if it revolutionises your investing style!

The Financial Expert™ Best Derivatives Book Challenge is a well-loved feature of this website.

Derivatives are complex, notoriously so.

Even the best derivatives book won't allow you to master derivatives in a single read. That would take 12 books, hence the derivatives book challenge:

I challenge you to read one derivatives book per month for the next year, and become an expert!

In few fields are intelligence & knowledge so richly rewarded as the field of derivatives. It pays to become an expert.

In sharp contrast, knowing only a little about derivatives can be pretty dangerous.

Knowing a little about derivatives could give you the inspiration to begin a trade idea, and to enter into large obligations, either personally or for your employer, but:

- Underestimate the risks

- Fail to foresee a possibly adverse interaction between different instruments

- Create an ineffective hedge

It's also important to understand as much as possible about any financial derivative, such as:

- The regulatory environment

- Any particular quirks or unique characteristics about the market on which the instrument is traded

- How the instrument is accounted for, and disclosed in financial statements.

By stacking up multiple derivatives titles, you can make derivatives your career opportunity, rather than a career risk.

Know your structured collars from your symmetric collars? That's just the beginning!

Expand your existing knowledge into other similar, or connected derivatives to broaden the range of financial instruments that you could use for your next trade idea.

Not only are there numerous derivative types, there are many ways to use them in almost limitless combinations. The more derivatives books you read, the more real-life examples you can observe with context, which might enable the next light-bulb moment whilst you're at your desk.

Some guidance

- I found it helpful to stock up on books for the next few months, so that when a new month rolls around, my next book was my bed-side table asking to be opened!

- Pick a variety of styles. This will keep the challenge fresh and increase the diversity of opinion.

- Pick at least one book that you don't think you would enjoy, this book might be the one that surprises you the most!

- If you're time-starved, audio books are absolutely fine!

Where to begin?

My list of the best derivatives books above is as good as any place to start, as I have consciously included a mix of different writing and investment approaches to ensure that it caters to a wide audience.

Good luck!

Even the best derivatives books offer a single perspective

"By far the most significant event in finance during the past decade has been the extraordinary development and expansion of financial derivatives."

Derivatives books come in a couple of varieties - derivatives books that provide opinions, and books that deliver facts and information.

For example, Options, Futures and other Derivative is very factual, and reads almost like an encyclopaedia. It will contain data, accurate descriptions, and historical information to factually describe events which have led to the development of the derivatives markets.

Traders, Guns and Money in contrast is an opinionated piece, weaving biography with anecdotes with personal insights about working at a derivatives desk. It's funny, entertaining, and still informative.

Use critical thought when you pick up a new derivatives book. Wonder: "Is this derivatives title attempting to teach me or persuade me?"

That's quite an important thought process.

That's because as you're learning about any subject, (and derivatives is no different), your brain is placing this information into a structure. The more informed and carefully placed, the better your power of recall, and the more detailed relationships you'll be able to draw between different pieces of information.

Selecting the best UK derivatives books for beginners

These curated lists of derivative books are home to some of the best derivatives books for beginners in the UK.

But how can you pick the best UK derivative books for your own personal book shelf? I suggest:

- Choosing a title which really intrigues you - a book that you want to pick up and read, rather than feeling like a chore.

- Looking for simple language and straight-forward explanations. Avoid an author who feels the need to write too academically if you want to take away an intuitive understanding.

- Picking books for their breadth and not their depth.

You have many weeks ahead to add specialist titles to your shelf, giving you the option to dive into the minutiae of any topic of your choice.

As a beginner, it's important to not bog yourself down in the details of a particular regulation or the exact pricing formulae of a binomial option.

The main objective of your first book about financial derivatives should be to inspire you to read more. Not to teach you everything you need to know.

Derivatives is such a large topic that the best derivatives book still couldn't touch the sides. Your journey from beginner to pro will therefore be a marathon and not a sprint.

You therefore want your first derivatives book to motivate you to take that journey, and to act as a signpost to show you were you might want to explore, and to show you the general lay of the land.

Explore the best books in more genres

General personal finance

Trading the financial markets