Last updated: 20 December 2021.

Welcome to our ranking of the best portfolio management books available online or in stores. Managing an investment portfolio is a tricky but compelling task. Can you find the perfect blend of assets that will deliver investment success?

Your investment portfolio is your wealth creation tool. Invest in yourself by learning more about portfolio management, which can also be done for free for a month with Amazon's Kindle Unlimited free trial.

If you click on any book in the top 5 ranking or the collections of supplementary books which I've curated, you'll be able to see the price on Amazon, which is usually the most competitively priced online store for books. As an Amazon Associate, I earn a small commission from qualifying purchases which helps to support this site. This does not impact how I compile the list. Happy reading!

About portfolio management books

These books are aimed at two groups of readers:

1) Finance professionals who work in the asset management industry. This could include financial advisers, wealth management practitioners and fund managers/staff.

2) Retail investors who are managing their own portfolio, for medium term or retirement.

Books tailored to each group of reader cover the same topics, but with a different level of technical detail. If you're interested in portfolio management books, you may be interested in picking up a book about the discipline of asset allocation. Check out our ranking of the top asset allocation books.

A word of warning, the technical end of the spectrum is data-heavy and won't grab your attention as a reader like the beginner books will. So if you're new to the topic of portfolio management, I encourage you to buy a book for beginners rather than overstretch into a professional title. You run the real risk of not completing that book!

Discover prime books on investing and finance

No boundaries, just your curiosity- Invest with confidence

- Finance industries

- Real estate & real assets

- Exotic investments

- The bigger picture

Books reviewed

Financial Expert 2024 Book Awards

Gold Prize

Financial Times Guides: Investing by Glen Arnold

Portfolio management books for beginners

Don't go it alone, arm yourself with the best companion: knowledge!Classic portfolio management books

Best sellers with undying popularity among professionals and retailer investors alikePortfolio management books for students & serious learners

Take a shortcut to the excellence resources that professional investors use themselvesFinancial Expert tip: The hardcover versions of these financial planning books are in high demand! They can recoup up to 80% of their cover price when sold in good used condition.

Therefore if you plan to eventually sell back a title, your net cost could be as low as 20% of the cover price.

Click on the covers below to look at the used prices of these titles on Amazon to understand what cash back you could expect.

Specialist portfolio management tiles by the Financial Times

Detailed guides to asset classes you may feature in your portfolioPortfolio management books for finance professionals

Find technical reference guides and detailed insights into the wealth management industryDownload all these portfolio management books for free with Kindle Unlimited

You DON'T even need a Kindle device to download booksHere's a useful tip that will save you £100+ on portfolio management books. Sign-up to Amazon's Kindle Unlimited free trial, which offers access to all titles for free for 30 days.

- There's no obligation to continue with a paid subscription.

- You don't even need a Kindle to enjoy - any device will do.

If you're cost-savvy, you'll already be calculating the savings you could unlock and the knowledge you could gain by downloading 5 books over the next 30 days.

My Top 5 Portfolio Management Books for 2022

Click through any of the covers to see latest reviews and prices1. Wealth Management (FT Guide) - Jason Butler

Financial Expert Rating:

Synopsis:

"The Financial Times Guide to Wealth Management is your comprehensive guide to achieving financial security and stability by planning, preserving and enhancing your wealth.

As well as being fully updated throughout, it includes five new chapters on socially responsible and impact investing; property, land and woodlands; single premium investment bonds; non-trust structures and young people and money.

- Define your life goals and financial personality so that you can build an effective wealth plan

- Navigate the maze of investment options and choose the best one for your needs

- Understand when and how to get professional help which delivers value

- Clarify the need for and role of insurance, tax structures, pensions and trusts

- Develop a wealth succession plan which matches your values and preferences"

Who this book is for:

I've reserved the top portfolio management book spot for my personal favourite - the Financial Times Guide to Wealth Management: How to plan, invest and protect your financial assets.

A comprehensive guide for those who are serious about immersing themselves in wealth management.

If you consider yourself fairly new to investing, I personally recommend this book as the best resource for learning the framework for how to best manage your money according to your life goals.

Jason handles many complex topics, such as portfolio management, inheritance tax with ease. This new edition includes all-new chapters on land, property and investment bonds has kept the guide relevant to modern investors.

If I could suggest only one wealth management book on this page, it would be Wealth Management: How to Plan, Invest and Protect your Financial Assets by Jason Butler.

Pro tip:

Financial Expert Rating:

Synopsis:

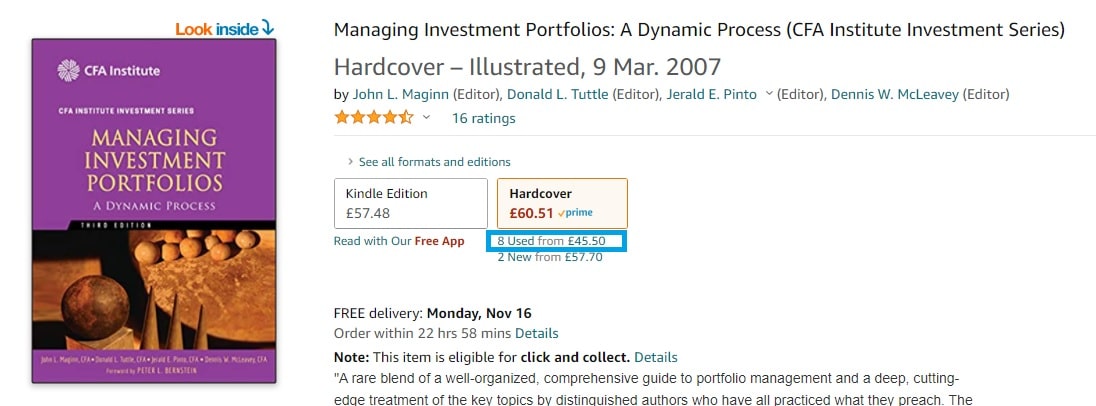

""A rare blend of a well-organized, comprehensive guide to portfolio management and a deep, cutting-edge treatment of the key topics by distinguished authors who have all practiced what they preach.

Just reading Peter Bernstein's thoughtful Foreword can move you forward in your thinking about this critical subject."

- Martin L. Leibowitz, Morgan Stanley

"Managing Investment Portfolios remains the definitive volume in explaining investment management as a process, providing structure to a complex, multipart set of concepts and procedures.

Anyone involved in the management of portfolios will benefit from a careful reading of this new edition."

- Charles P. Jones, CFA, Edwin Gill Professor of Finance, College of Management, North Carolina State University."

Who this book is for:

If you've noticed that retail investors are pointed towards 'quick and easy' guides, while professional study in detail. You might be wondering... is there anything stopping a retail investor reading the good stuff?

Answer: There's absolutely no reason why you cannot read the same books as the students qualifying to be chartered financial advisers and portfolio managers.

Take this book; Managing Investment Portfolios by the Corporate Finance Institute (CFA).

For less than £70, you can own a truly comprehensive guide to the inner workings of the wealth management process.

Complete with theory, case studies and questionnaires, this textbook will arm you with everything that the professionals know.

Financial Expert tip: The hardcover versions of a few of the portfolio management books listed here are in high demand! They tend to hold about 60 - 80% of their value when sold in used condition.

Therefore, it's often much cheaper in the long run to buy physical copies over ebooks, even if the ebook is priced slightly cheaper.

Financial Expert Rating:

Synopsis:

"The Financial Times Guide to Saving and Investing for Retirement will lead you through a bewildering maze of financial tools and provide advice on crucial investment decisions. It provides everything you need to know about how to save and invest so that you can successfully plan for your retirement. It is packed with invaluable information on taxes, ISAs, pensions, investing across different assets and buying property.

The Financial Times Guide to Saving and Investing for Retirement will help you:

- Identify your financial objectives and work out how to achieve them

- Learn how to invest for a specific goal and time

- Find out about taxes and other rules that may impact your wealth

- Understand why it’s essential to be actively involved in managing your post-work income"

Who this book is for:

The Permanent Portfolio is something of a biography blended with portfolio theory.

It's an unusual blend which actually works really well!

In The Permanent Portfolio, Craig Rowland and J.M. Lawson take us through principles behind creating a permanent portfolio, as followed by Harry Browne - a legendary investing analyst.

What's a permanent portfolio? It's a blend of investments which you can buy, and then immediately forget about.

Boom or bust, growth or recession, a permanent portfolio is designed to weather the storm and save you £00's in trading fees each year. It's a refreshing approach which isn't often discussed because many stockbrokers and industry bodies don't want to see the end of the huge trading volumes caused by panicked investors changing their minds every six months.

And with 77% five star reviews, I can see that the readership of this book agree with me.

Financial Expert Rating:

Synopsis:

"For students of finance at both undergraduate and postgraduate level, or those preparing for professional examinations, Investment and Portfolio Management develops knowledge and understanding of the key financial products, investment strategies and risks in financial markets in the UK and internationally.

With an emphasis on practice, Investment and Portfolio Management presents the theory and its relevance and application in the financial workplace.

The authors draw on their experience working in the financial sector to illustrate concepts with case studies, examples and problems, including material relevant to candidates studying for professional examinations offered by the major professional bodies in the subject area.

Each chapter is written in an easy-to-follow style, allowing readers to navigate their way through different topics without issue, avoiding complicated technical jargon, in favour of simpler terms and writing style."

Who this book is for:

If you're looking for one of the best portfolio management books, look no further than Investment & Portfolio Management: A Practical Introduction by Ian Pagdin and Michelle Hardy.

This is a current and up-to-date edition of a book used in investing courses and undergraduate programmes the world over.

And for the low price quoted on Amazon, you're able to skip straight to the knowledge by owning this book yourself.

In its 14 chapters, you'll cover fundamental backgrounds about risk and the financial markets. Followed by the roles of market participants and gradually you'll find yourself in chapters concerning detailed portfolio theory, which is the reason you bought the book.

I consider this book to be an excellent guide, and for under £50 it's a steal - university textbooks are usually priced at £60 - £80!

Financial Expert Rating:

Synopsis:

"Be Your Own Financial Adviser shows you how to make sensible financial decisions without the need for expensive advice.

Its accessible style, examples and case studies explain and evaluate financial products and put you firmly in control of your own financial well-being.

Good financial planning requires a systematic strategy. You should start by assessing your own particular circumstances, attitudes and timescales and then work out how you can implement your strategy on a long term basis.

Let Be Your Own Financial Adviser be your guide to making better financial decisions.

It includes advice on the following:

- Financial planning

- Building a pension

- Saving and investing

- Managing your wealth"

Who this book is for:

Be Your Own Financial Adviser joins this list at #5 because it offers a simple guide to portfolio management which is both accessible and satisfying for beginners.

Let's not understate the value of a book which is both informative and enjoyable at the same time!

Jonquil Lowe frames each chapter of this book through the lens of making better financial decisions. And who wants anything less than that?

Download all these portfolio management books for free with Kindle Unlimited

You DON'T even need a Kindle device to download booksHere's a useful tip that will save you £100+ on portfolio management books. Sign-up to Amazon's Kindle Unlimited free trial, which offers access to all titles for free for 30 days.

- There's no obligation to continue with a paid subscription.

- You don't even need a Kindle to enjoy - any device will do.

If you're cost-savvy, you'll already be calculating the savings you could unlock and the knowledge you could gain by downloading 5 books over the next 30 days.

Portfolio management is a skill which will never die

"The most important asset you need to protect in order to manage the demands of a job or an investment portfolio is your production of energy. And, just like with money, if you do a great job managing your energy, you'll get a great return."

When it comes to choosing a book, one tries to pick a topic which will be useful. A topic which will be enjoyable to learn, and will create and satisfy a sense of curiosity as I turn the pages.

But most of all, if I'm going to invest time to learn a new skill, I want some assurance that the tricks and techniques that I'm learning won't become obsolete by the end of the year.

The best portfolio management books tick these boxed for me.

Portfolio management is a timeless science

As you will know, asset classes tend to move in cycles, relatively independently to others.

Perhaps investing in emerging markets is hot for 4 years, followed by a sharp retraction of retail investor money following a crash. Next, domestic property may become a fashionable zone, before small-cap equities take the lead as measured by annual price growth.

In this ever-turning wheel of investor preference, the one common theme is the medium of the investment portfolio.

Every investor, from the most sophisticated to a newbie, will have a portfolio. It might be lean, it might be archaic, but most of all, it's uniquely theirs.

As you read the best portfolio management books, you'll be able to refine and hone your own unique approach.

Perhaps your eyes will be opened to a new asset class which you'd never previous given serious thought to. Alternatively, you may be convinced by a minimalist author that your holdings have become too unwieldy to deliver efficient returns.

Whatever the inspiration, I am sure that you will find much to love in the selection of portfolio management books above, whether in the top 5 shortlist or the groups of sub-categories.

Selecting the best UK portfolio management books for beginners

"Many novice real estate investors soon quit the profession and invest in a well-diversified portfolio of bonds. That's because, when you invest in real estate, you often see a side of humanity that stocks, bonds, mutual funds, and saving money shelter you from."

Portfolio management is an essential skill for investing beginners to gain before they make their first investment.

Just as an artist won't place their brush on canvas before they envisaged what they were creating, investors shouldn't begin adding stocks and shares to their portfolio without having a clear plan of how they are building towards a whole which works for them.

Investment portfolios are essentially risk-management tools. This ironically means that beginners - who are perhaps the most risk averse of all investors - generally lack the skills needed to protect themselves from what they fear.

Market crashes of course will happen. By now, we can appreciate that stock market tumbles are as evitable as the rising and setting of the sun.

That's where a diversified investment portfolio really comes into its own. In boom years, carefully selected asset classes such as some defensive domestic stocks, or low-yielding government bonds might have looked terribly unattractive to a new investor. But in a crisis, these assets can become your life raft, your insurance policy, your cushion.

We are taught to keep a long term focus when investing. I'll let you into a little secret - it's a lot easier to do that when your portfolio is working just as hard during gloomy periods as it is when the property and stock markets are firing on all cylinders!

Managing a portfolio

Portfolio management can be simple or complex. You can stick with a simple asset allocation, or construct an elaborate portfolio including every major asset class. There are pros and cons to both approaches.

Building an investment portfolio is ultimately about achieving two things:

- Finding the right balance between risk and reward which is suitable for you or your clients

- Choosing the best assets that maximise the reward for the amount of risk

The best portfolio management books will naturally take you through a lot of the science behind a great investment portfolio, You may also find real examples of portfolios that have worked incredible well over historical periods.

That being said, once you've read a few portfolio management books, you may have the confidence to go for a very pared-back approach. Simplicity is the ultimate expression of confidence in the fundamental principles behind your portfolio.

Explore the best books in more genres

General personal finance

Trading the financial markets