Last updated: 20 January 2021.

Welcome to the premier collection of wealth management books available online and in local book shops. This is an impartially produced ranking of the best wealth management books I could find, as well as many other close contenders for that title, presented in a series of shortlists. I hope you find my curated collections helpful in your search for reliable wealth management strategies.

This page features the best wealth management books for:

- Finance professionals

- Retail investors

- Sophisticated investors

In terms of price, it's a wide range. Accessible paperbacks for beginners could cost as little as £8, whereas a reputable authority sources for professionals could cost upwards of £50, (don't worry though - these types of books tend to hold their value in the second hand market).

Regardless of the price, remember that most books can be read for free with Amazon's Kindle Unlimited free trial.

Click on any title below to see the latest price from Amazon, you'll be shocked at how affordable the most popular titles are. As an Amazon Associate, I earn a small commission from qualifying purchases which helps to support this site. This does not impact how I compile the list. Happy reading!

Discover prime books on investing and finance

No boundaries, just your curiosity- Invest with confidence

- Finance industries

- Real estate & real assets

- Exotic investments

- The bigger picture

Books reviewed

Financial Expert 2024 Book Awards

Gold Prize

Financial Times Guides: Investing by Glen Arnold

Wealth management books for finance professionals

Find technical reference guides and detailed insights into the wealth management industryDo it yourself: the best wealth management books for beginners

Don't go it alone, arm yourself with the best companion: knowledge!Perspectives on wealth

Thoughtful titles which look behind the stock market indices to examine the nature of wealthClassic wealth management books

Best sellers with undying popularity among professionals and retailer investors alikeSpecialist wealth management tiles by the Financial Times

Detailed guides to investing topics from the leading UK financial publisherDownload all these wealth management books for free with Kindle Unlimited

You DON'T even need a Kindle device to download booksHere's a useful tip that will save you £150+ on wealth management books. Sign-up to Amazon's Kindle Unlimited free trial, which offers access to all titles for free for 30 days.

- There's no obligation to continue with a paid subscription.

- You don't even need a Kindle to enjoy - any device will do.

If you're cost-savvy, you'll already be calculating the savings you could unlock and the knowledge you could gain by downloading 5 books over the next 30 days.

My Top 5 Wealth Management Books for 2022

Click covers to see latest reviews and prices1. Wealth Management (FT Guide) - Jason Butler

Financial Expert Rating:

Synopsis:

"Whether you’re a beginner wanting an introduction to financial planning or an experienced investor looking to pass your wealth on to others, this is the book for you. Drawing on his 25 years’ experience as a financial adviser to successful families, and written in clear and concise language, Jason Butler will give you both the understanding and confidence you need to make successful financial decisions, enabling you to:

- Define your life goals and financial personality so that you can build an effective wealth plan

- Navigate the maze of investment options and choose the best one for your needs

- Understand when and how to get professional help which delivers value

- Clarify the need for and role of insurance, tax structures, pensions and trusts

- Develop a wealth succession plan which matches your values and preferences"

Who this book is for:

A comprehensive guide for those who are serious about immersing themselves in wealth management.

If you consider yourself fairly new to investing, I personally recommend this book as the best resource for learning the framework for how to best manage your money according to your life goals.

Jason handles many complex topics, such as portfolio management, inheritance tax with ease. This new edition includes all-new chapters on land, property and investment bonds has kept the guide relevant to modern investors.

If I could suggest only one wealth management book on this page, it would be Wealth Management: How to Plan, Invest and Protect your Financial Assets by Jason Butler.

Pro tip:

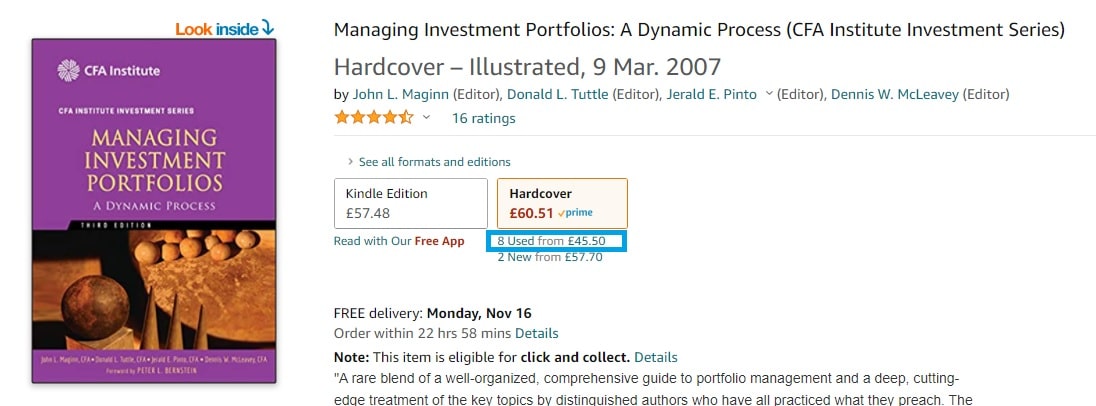

Financial Expert Rating:

Synopsis:

""A rare blend of a well-organized, comprehensive guide to portfolio management and a deep, cutting-edge treatment of the key topics by distinguished authors who have all practiced what they preach.

Just reading Peter Bernstein's thoughtful Foreword can move you forward in your thinking about this critical subject."

- Martin L. Leibowitz, Morgan Stanley

"Managing Investment Portfolios remains the definitive volume in explaining investment management as a process, providing structure to a complex, multipart set of concepts and procedures.

Anyone involved in the management of portfolios will benefit from a careful reading of this new edition."

- Charles P. Jones, CFA, Edwin Gill Professor of Finance, College of Management, North Carolina State University."

Who this book is for:

If you've noticed that retail investors are pointed towards 'quick and easy' guides, while professional study in detail. You might be wondering... is there anything stopping a retail investor reading the good stuff?

Answer: There's absolutely no reason why you cannot read the same books as the students qualifying to be chartered financial advisers and portfolio managers.

Take this book; Managing Investment Portfolios by the Corporate Finance Institute (CFA).

For less than £70, you can own a truly comprehensive guide to the inner workings of the wealth management process.

Complete with theory, case studies and questionnaires, this textbook will arm you with everything that the professionals know.

Financial Expert tip: The hardcover versions of the top 3 wealth management books listed here are in high demand! They tend to hold about 60 - 80% of their value when sold in used condition.

Therefore, it's often much cheaper in the long run to buy physical copies over ebooks, even if the ebook is priced slightly cheaper.

Financial Expert Rating:

Synopsis:

"The Financial Times Guide to Saving and Investing for Retirement will lead you through a bewildering maze of financial tools and provide advice on crucial investment decisions. It provides everything you need to know about how to save and invest so that you can successfully plan for your retirement. It is packed with invaluable information on taxes, ISAs, pensions, investing across different assets and buying property.

The Financial Times Guide to Saving and Investing for Retirement will help you:

- Identify your financial objectives and work out how to achieve them

- Learn how to invest for a specific goal and time

- Find out about taxes and other rules that may impact your wealth

- Understand why it’s essential to be actively involved in managing your post-work income"

Who this book is for:

If you're looking to expertly manage your savings through to retirement, this guide is for you.

Most wealth management books cover all bases with their content, which ultimately leaves fewer pages for the issues which are more appropriate for your circumstances.

This excellent title by Yoram Lustig will help you tackle the questions you may have when saving for your retirement, such as :

- What types of investments are most suitable for long term time horizons?

- How much risk is sensible in a pension fund versus a normal savings pot?

- How should a retirement portfolio evolve as the retirement date approaches?

Financial Expert Rating:

Synopsis:

"The best-selling index investing bible offers new information and is updated to reflect the latest market data The Little Book of Common Sense Investing is the classic guide to getting smart about the market.

Bogle describes the simplest and most effective investment strategy for building wealth over the long term."

Who this book is for:

This book is for investors looking for a simple and effective investing approach. John Bogle promotes a minimalist approach to investing, which came to define his ground-shaking impact on the industry.

In short, it's about using passive funds to reduce investing costs and build a basic investment portfolio which will do the distance over the long term.

John Bogle is the founder of Vanguard, the leading provider of index funds in the US.

Financial Expert Rating:

Synopsis:

"Be Your Own Financial Adviser shows you how to make sensible financial decisions without the need for expensive advice.

Its accessible style, examples and case studies explain and evaluate financial products and put you firmly in control of your own financial well-being.

It will advise on how to adopt the best saving, spending and investment strategies, make decisions tax-efficiently, manage risk wisely and protect and enhance your wealth.

Be Your Own Financial Adviser will show you how to:

- Stress-test your financial decisions

- Take advantage of legal tax breaks

- Achieve your financial goals

- Manage and preserve your wealth"

Who this book is for:

Be Your Own Financial Adviser joins this list at #5 because it offers a simple guide to wealth management which is both accessible and satisfying for beginners.

Let's not understate the value of a book which is both informative and enjoyable at the same time!

Jonquil Lowe frames each chapter of this book through the lens of making better financial decisions. And who wants anything less than that?

The Financial Expert™ Best Wealth Management Book Challenge

I challenge you to read one wealth management book per month and see if it helps you achieve your goals!

The Financial Expert™ Best Wealth Management Book Challenge is a well-loved feature of this website.

Think of it as a nudge of encouragement to do more of what you enjoy, but probably wish you could do more of: reading!

This is as much a personal development initiative as it is a financial one - spending time on your own learning and development (particularly once out of education), can be incredibly rewarding.

By purposefully investing your time and attention in something that's constructive, positive and intellectual, you'll give yourself something to think about beyond the day to day worries of life and work.

Here's the challenge - it's as simple as this:

Read one wealth management book per month for the next year.

It's a book binge, a tower of titles! Pick 2-3 books today to add to your collection. Once you've finished reading, sell them on Amazon or Ebay to recoup much of the cost and keep on going.

If you've read an eye-opening book recently, you'll appreciate the power a book has to change your perspective on a topic.

Now imagine doing that ... every... month.

Some tips to make this easier:

- I found it helpful to stock up on books for the next few months, so that when a new month rolls around, my next book was my bed-side table asking to be opened!

- I encourage you to pick a random assortment of titles - don't stick to the same series. This will keep the challenge fresh and increase the diversity of opinions you'll be exposed to.

- Pick at least one book that you don't think you would enjoy, this book might be the one that surprises you the most!

- If you're time-starved, audio books are absolutely fine!

Where to begin?

My list of the 5 best wealth management books above is as good as any place to start, as I have consciously included a mix of different writing and investing styles to ensure that it caters to a wide audience.

Good luck!

Wealth management books to avoid

A not-so-credible testimonial"Using the 2 minute technique uncovered in this book, I invested 30p and two weeks later I had amassed a fortune of £800,000!"

I deliberately avoided a whole sub-genre of wealth management books when picking my 5 favourite wealth management books above.

I decided to exclude the genre known as get-rich-quick books.

You might have bumped into them before. They will usually:

- Focus on a very specific form of investment

- Include a small novel quirk or twist

- Be plastered with attention-grabbing statements such as 'you'll never need to work your day job again!'

I won't refer to any disreputable titles by name as I don't want to provide free publicity. But I generally consider the of the following words in a book title to be general indicators (although not in every case) that a book may disappoint:

Millionaire, Gold Mine, Rich, Secret Techniques

You'll often find them being marketed or handed out for free as part of expensive video courses, investment training programmes and investment scams.

To try and sort the wheat from the chaff, I recently collated my own list of the best get rich quick books, in which I highlight a few books which could be considered as 'get rich quick' books, but which I believe contain useful ideas and concepts, and are essentially the bright sparks of the genre.

After all, I have nothing against a book which inspires, motivates and improves an investors mindset.

I would only have criticism where a book fails to deliver on wholly unrealistic promises, or encourages the reader to take risks that will clearly only be appropriate for a small minority of the general public.

I understand that selling the dream of a work-free future is far more lucrative than trying to charge £59 for a detailed guide to running an investment portfolio, but it's not a decision I will support.

I find that the more hard-sell techniques used to sell a product, the more likely that it will disappoint.

Explore the best books in more genres

General personal finance

Trading the financial markets