What is life insurance?

Term life insurance is a highly popular type of insurance policy that pays out an agreed sum if you die within an agreed period (the term).

The cost of life insurance is usually quoted as a monthly payment, known as the premium. If you fail to keep up with the premiums, the policy will become void and you will lose your cover.

Life insurance policies cover you over a fixed period of time, but you can choose the length of the term when taking out the policy.

It is also possible to buy whole of life insurance or over 50’s life insurance plans which will cover you for an indefinite period until you die. Because these policies are very likely to pay out at some point, they are much more expensive and feel closer to savings accounts than life insurance. We’ll cover these later on.

A simple term life insurance policy example:

The life is insured for a fixed £500,000, over a 30-year term starting 1 January 2020 and ending 31 December 2049. The premium payable is £17.70 per month.

What term life insurance is not

Term life insurance should not be confused with other insurance policies which payout in hardship:

Private medical insurance – which covers most costs of obtaining private treatment if you are diagnosed with a wide list of conditions

Healthcare cash plans – which pay out fixed cash sums if you suffer a specific injury or illness, such as £100,000 paid out if you lose your sight.

Over 50’s plans – which pay out a fixed sum in the event of your life, so long as premiums continue to be paid. These differ from term life insurance because they have no fixed term.

Payment protection insurance – which pays out enough to cover debt repayments in a wider variety of circumstances, including loss of a job or poor health.

Term life policies may contain some special features which blur the lines with the other policies above. They might even be packaged with other insurance policies, making it difficult to tell them apart.

For example, some term life cover will payout in the event of you being given a terminal diagnosis.

However, only a small fraction of claimants will trigger this condition. Therefore if you need broad coverage for medical expenses, you should look for a specialist medical insurance policy instead.

Remember the rule of thumb: life insurance is primarily for the benefit of those who survive you, are not designed to benefit you personally.

Do I need life insurance?

You may need life insurance if you want to:

- Protect the lifestyle of your family should the worst should happen

- Provide financial support for dependent relatives

- Ensure the continuity of your small business

- Take care of your funeral costs and relieve others of that burden

- Pass on a meaningful inheritance to others, rather than debt!

As you can see, there are many reasons that people take out life insurance, but these motivations can be grouped into two themes:

Continuity – allowing those who depend upon you to continue living their lives to the full.

Legacy – allowing you to leave behind a substantial gift which will help the lives of others.

Do I already have life insurance?

You may already have some limited life insurance coverage without even realising it. This may come courtesy of a workplace life insurance scheme provided by your current employer.

Many employers pay a small premium to provide life insurance known as a death in service benefit to all of their employees.

There is a common misconception that you actually need to die at work, or in a workplace incident to qualify for a payout. This is not the case as death in service cover is simply another name for term life insurance.

The key difference between a personal plan and an employer plan are that your employer takes care of the premium payments for you, and the policy will automatically expire if your employment contract is terminated.

The insured amount is usually defined as a multiple of your pre-tax salary. For example, if you earn a gross salary of £30,000 per year, then a policy with a 2.5 x multiple would pay £75,000 if you died.

The limitations of these policies are that the payout is often insufficient to cover your needs.

- Would 2.5 x your salary cover the remaining mortgage on your house?

- Would it take care of your children’s education until they graduate from university?

Often the answer to this question is no, which is why employees with death-in-service cover choose to top up their life insurance by taking out a personal policy.

The different types of life insurance

It’s worth understanding the different types of life insurance available before you begin looking at providers and prices:

Term life insurance

Term life insurance is a basic policy which will payout a fixed amount if you die within a specific time period.

Increasing term

Increasing term cover will pay out a flexible sum which rises as you move through the term. As the cover increases, so will the monthly premium. This is also known as indexation.

This type of insurance recognises that that price inflation will erode the value of a payout sum which stays still.

A £1m payout in 30 years time will not be able to buy as much as £1m today. This means that the real value of ordinary life cover decreases over time, which is not normally the intention of the policyholder at all.

By choosing an increasing term policy, you can protect the ‘real’ value of the payout.

However, many insurers inflate the cost of the premium at a faster rate than the size of the payout. This can make the policies poor value for money, as this means you will be paying a higher price for the additional coverage than for the original sum.

Decreasing term

Decreasing term cover is a policy designed for a single purpose: to allow you to clear a debt if you die before making your final repayment.

People often take out a decreasing term policy at the same time they take on a joint mortgage.

A mortgage is a serious obligation, and many couples worry that their partner may be unable to afford the repayments if death meant that one income suddenly vanished.

With decreasing term cover, the initial insured sum is equal to the full value of the mortgage. The policy is written so that the cover tapers off over time, roughly in line with the expected size of the mortgage.

By only taking out the minimum coverage needed to pay off the shrinking debt, financial protection can be achieved for the lowest cost.

Decreasing life insurance is sometimes confused with payment protection insurance or PPI, for short. PPI covers a loss of income in a wider range of circumstances, such as job loss, illness or if you suffer an accident.

For this reason, PPI is arguably much more effective in covering the risk of you being unable to make payments. However, it is much more expensive as a result.

Whole of life cover

Whole of life cover will payout on your death, whenever that may be. You could see it as term insurance with an unlimited term.

Because you can expect a policy to payout, you will find that the total premiums you can expect to pay (based on an average life expectancy) will exceed the amount your relatives will receive.

Therefore, whole of life cover isn’t designed to make anyone rich, they’re designed to guarantee that a sum of money will be available to cover funeral costs etc, even if you don’t currently have a pot of savings.

All you need is enough disposable income to be able to comfortably pay the monthly sum.

A guide to whole of life cover

Whole of life cover is like term insurance with an indefinite term that lasts until you die.

This small tweak makes a huge difference.

Term life cover is usually taken out over the working years of our lives.

As actuarial tables will tell you, the odds of actually dying during this period are small – much smaller than you might think.

These reassuringly tiny odds are why life insurance providers can write you a £1 million insurance policy for just £15 per month, and still make a profit.

Small premiums mean that we can view the payments as a minor outgoing which gives us some peace of mind. If the term expires and we’re still alive… this is excellent news!

However, if we try to insure our life during the later years when we expect to die, the math changes completely.

Insurers will need to charge us close to the payout amount, as they will be paying out on the policies becomes the norm, rather than a rare event.

Yet imagine the situation of someone who paid £800k in premiums for a £1m term life insurance policy, only to outlive their policy term by one week. Despite the huge cost, this policy would provide no payout.

Their descendants would have been much better off if they had placed their money in a savings account.

This example shows that in our later years, term insurance actually begins to feel like quite a risky investment, not quite as financially stable as it initially appeared.

A whole of life policy is designed to solve this problem. They’re almost guaranteed to payout, as the policy will last until you eventually die.

Because each account will payout, this makes them feel much more like a savings account. After all, you’re simply paying a financial institution a series of payments, in return for them paying out a large sum at some point in the future.

Who gains from whole of life policies?

The winners of whole of life policies are those who unfortunately die early, as their payout will be worth much more than the few premiums paid by that point.

Those who pay into their plan for decades and survive into their 90s will lose out, as their total premiums will actually exceed the payout amount they will get back in return.

In short, if you live longer than expected, you would be financially better off by saving the premiums instead. But of course, you cannot know this in advance.

These two scenarios demonstrate why this is an insurance product and not a savings account. The amount paid to your relatives has no connection whatsoever to the value of premiums you have paid in.

Who needs a whole of life insurance policy?

The purpose of whole of life cover is to ensure that when the worst happens, there will be a tidy sum available to cover funeral costs and provide a small inheritance to loved ones.

During our later years, the cost of good care and accommodation can significantly erode the pension income and savings of an older person. By setting aside some money into a whole of life policy, you are effectively ring-fencing a sum that cannot be spent. Therefore it guarantees that you will have something left over, even if you spend 10 years in a care home.

If you have quite substantial assets and you feel that it is quite unlikely that care costs will have a significant impact on your estate planning, then there may be little incentive to take out a policy.

How much does life insurance cost?

Term life insurance is much cheaper than you think.

I was recently quoted just £18.86 for a 30-year policy providing £750,000 of cover.

The total premiums payable under that policy would total £6,800 before I turn 60. That’s not an insignificant sum, but in the context of the size of the policy, this feels like great value.

To make a profit on that cover, the odds of my death in the next 30 years must be comfortably under 1% for the insurer to make a profit.

Here’s why: at a price of £6,800, the insurer will need to write over 110 policies to collect enough cash to pay a single claim.

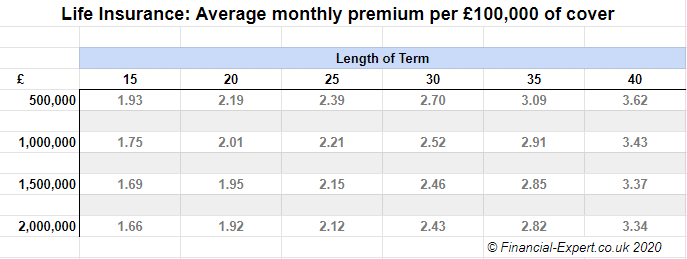

I obtained many quotes from a major UK provider of life insurance and compiled the following table.

It shows the monthly premium per £100,000 of life cover for 4 different sizes of life insurance plan; a £500k policy, a £1m policy, a £1.5m policy and a £2m policy:

We can see that the price of cover increases for longer policies. This makes sense because longer policies will have older policyholders, and thus an increased risk of death during the policy term.

The table suggests that life insurance appears to get slightly cheaper (per £ of cover) if you opt for a larger policy.

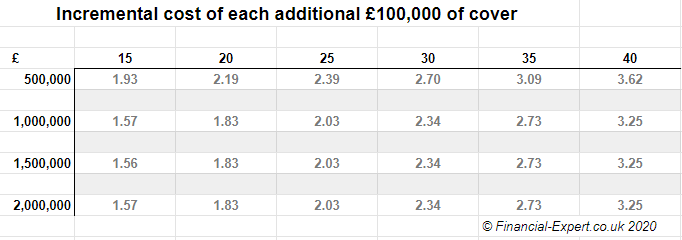

To show how this works, I recalculated the data to show, the incremental cost of adding an additional £500,000, compared to the smaller policy above it.

The data shows that the insurer charges a higher rate for the first £500,000 of cover (£1.93 – £3.62 depending on the term length).

However, when increasing the policy to £1m, £1.5m and even £2m, the increase in premium was at exactly the same rate.

In other words, with this insurer at least, buyers of huge policies saw no ‘bulk discount’ based on the size of the policy.

How to buy cheap life insurance

The best advice I have for buying cheap life insurance is to shop around online.

- Start with price comparison services to get a feel for the market

- Use these to experiment with length and size of life cover, to see how this impacts the monthly premium. The trade-off between level of cover and price will probably be similar regardless of the provider.

- Once you have a better idea of the specific policy you would like, seek out more insurers that deal with customers directly, and don’t feature on price comparison services. Cutting out the middleman could save you money.

- Even better, find a service which will cut you a great deal with your preferred insurer, and then rebate most of their commission back to you.

This way you can be sure that you found the best policy, at the best price, and then received a bonus ontop!

Be wary of the hidden costs of increasing or decreasing term life

When discussing increasing life cover above, I explained that insurers like to increase the premiums at a faster rate than the payout. This means that you overpay for the ‘inflation’ element of your insurance cover, compared to your starting coverage.

It may be more economical to simply take out a small additional term life insurance policy after 10 or 20 years, as a way of maintaining the real value of the insured amount.

At least this way, you can clearly see the cost of the coverage and you can compare that price against other providers. This may be cheaper than being locked into price increases with your original provider.

When shopping for decreasing life cover, you should be wary of price/cover differentials going in the opposition direction. Insurers will want to reduce the payout faster than the premium over the course of the term.