This article is part of my Q&A series on financial advice. Today’s question is ‘Do banks have financial advisers?’

With each year that passes, we seem to visit the bank branches less and less frequently.

When we do visit a branch, it is usually to either conduct an unusual transaction, or speak to a staff member in person. This could be about investments or mortgages.

But do banks have financial advisers? Are the friendly employees who talk to us about investment options qualified in the same way as chartered or certified financial planners who work for financial advice firms?

Do banks have financial advisers?

It’s worth pointing out that many banks call their branch employees ‘advisers’. This gives the impression that all staff are qualified financial advisers, when in fact they are not.

Bank staff are, of course, given plenty of training due to the huge responsibility on the shoulders of each employee who handles significant financial transactions and cash on behalf of customers.

As a result, banks seek to hire bright and conscientious individuals who are able to talk to us about a variety of savings, investments and insurance products.

However, taking a close look at recruitment helps us to understand the difference between branch advisers and what we typically understand to be a ‘financial adviser’.

This career guide lists as one of the advantages of being a branch advisor that you may ‘have the opportunity to move on to become a personal financial adviser’. This makes clear that a branch adviser and financial adviser are different roles.

It also lists the salary band as £16,500 – £25,000. This is lower than the average qualified financial adviser salary of £55k per PayScale.

Do banks hire any personal financial advisers?

Although branch advisers are not financial advisers, this doesn’t mean that banks don’t have financial advisers at all.

The same PayScale report showed that two of the top employers of certified financial planners was HSBC and Santander. This demonstrates that banks do have financial advisers on staff, they just aren’t based at every branch.

Indeed, online research shows that each of the large British banks offers a financial advice service. I’ll summarise their offerings as described on their websites (correct as of 2020).

Santander – Financial Planning Manager

Key details:

- Restricted adviser – will only offer Santander products

- £20,000 minimum investment

- Free introductory meeting

Fees

- The fee payable for advice is not quoted online

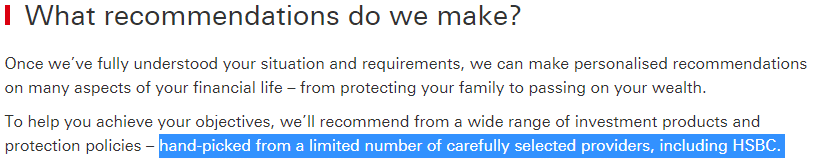

HSBC – Premier Financial Advice

Key details:

- Restricted adviser – will only offer products by HSBC or affiliates

- Must be an existing HSBC customer

- £50,000 minimum investment

- Free introductory meeting

- Second meeting to discuss recommendations

Fees:

- £960 or 2.75% advice fee if you implement the plan.

- £460 minimum advice fee if you don’t implement the plan

Natwest Premier Banking

Key details:

- Customers with incomes over £100,000 or investments over £100,000 automatical qualify for free premier banking services.

- Financial advisers are external. Natwest will refer you to an external qualified tax or investment adviser if you need one.

- External experts could be Independent Financial Advisers, it isn’t possible to say from Natwest’s website.

Fees:

- Referrals are free if you qualify for premier banking. Fees will be paid to external advisers accordance with their pricing schedule.

Lloyds Bank – Joint venture with Schroders Personal Wealth

Key details:

Like Natwest, Lloyds outsource their financial advice service to a third party. In this case, they have partnered with Schroders to be their exclusive advice provider.

On their own website, Schroder’s state that they provide restricted advice.

Do banks have independent financial advisers (IFAs)?

From the research above, we can see that each major bank offers to connect customers with either an in-house restricted adviser or an external adviser.

However, as can be seen above, none of these banks explicitly offer independent financial advice. That is, where the adviser would be able to make recommendations to you based upon the full range of investments available on the market.

Therefore while banks do have financial advisers, the research above indicates that they do not offer in-house independent financial advisers.

Therefore if you’re trying to find an independent financial adviser, I suggest that you undertake a broader search beyond your high street bank.

Of course, there are more banks than the big four discussed above, and banks continue to evolve their products over time, so it’s possible that this could change.