This Further Venture Capital Platform Review is a placeholder page about an upcoming product that is not yet available. Information is based upon the little publicly available information about Further as a start-up company.

Please come back in 6 – 12 months for an update on the Further.Finance venture capital platform, and a full review of this exciting marketplace in development.

About Further.Finance

Further or Further.Finance is the trading name of a new venture capital (VC) investment platform. When live, Further will offer retail investors access to previously exclusive VC investment opportunities.

If you want to invest in high growth start-ups right now, you’ll find it difficult if not impossible to do so.

Our article how to become an angel investor explains why investors shouldn’t consider investing directly in start-ups unless they have an investment portfolio worth £4m. (Hint: it’s due to how expensive it is to achieve diversification when investing as an individual.

That’s why venture capital funds and venture capital trusts exist. They provide investors access to diversified pool of start-up equity or debt investments. However many VC firms are either:

- Closed to new investment; or

- Don’t accept funds from retail investors

It’s simply easier for a top VCT to serve a handful of corporate or high net worth clients, than open their fund to thousands of small individual investors, many of whom may not understand the risks of venture capital funds.

This has made the question of how to invest in venture capital quite difficult to answer for everyday investors.

Further was created to fix this problem, and open the doors to venture capital for the individual investor by “democratising” investments into Venture Capital funds.

What does Further offer as a venture capital platform?

The stated goal of Further.Finance, per its website, is to “enable everyday investors to access the fastest-growing startups and the full range of tax benefits and rebates available by making these investments“. This refers to the many tax benefits of Venture Capital Trusts (VCTs), which are covered in great detail by books about venture capital funds.

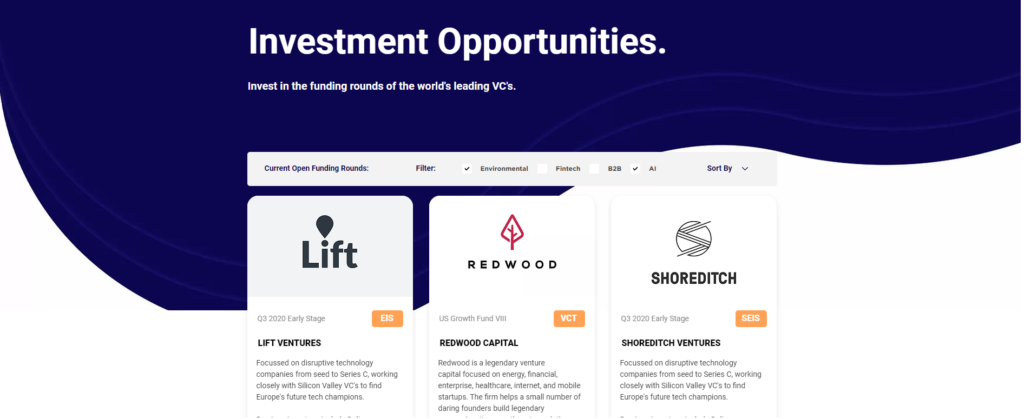

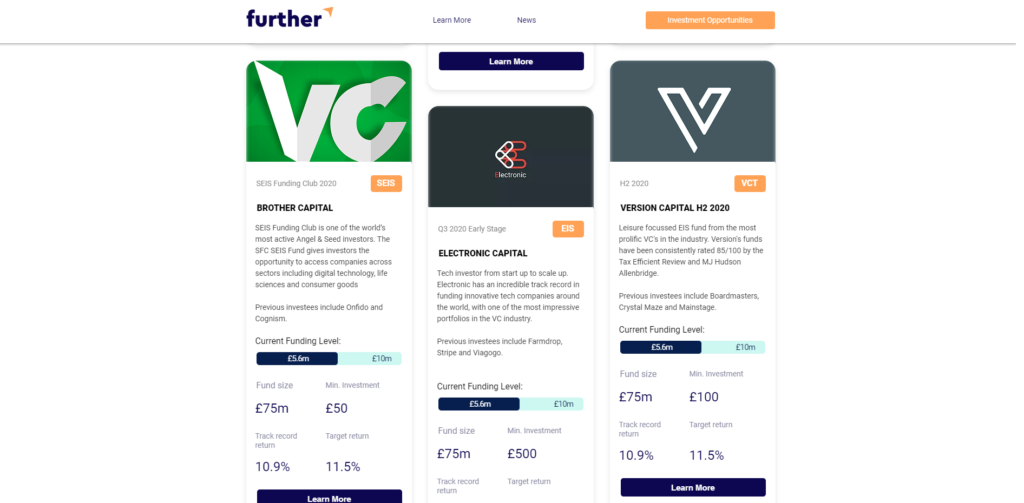

The platform will list UK VCTs which are currently open to new investment and act as an intermediary to help investors invest.

It has the potential to become a venture capital trust one-stop-shop. The only web platform that an investor needs to visit to:

- Get visibility of the wide range of venture capital offers

- Research the funds and compare and contrast the best UK VCTs, and

- Invest into their preferred VC fund a wide range of venture capital opportunities

Tracking the growth of Further as a business

Incorporation & regulation of Further

As a start-up in development stages, Further has not yet begun trading as a company.

Further is an intermediary between investors and venture capital funds, not unlike a financial adviser or wealth manager.

It will not physically invest cash in startups itself as it is not a venture capital fund.

We look forward to providing an update on the legal & incorporation status of the Further VC platform as it continues to develop.

The Further team

Further is co-founded by serial entrepreneur Rob Tominey, 32.

Rob is already well-known to the investment world. In 2014, he appeared on hit BBC show Dragons’ Den to pitch his business Mainstage Travel to the famous business angels. He secured a £100k investment from Piers Linney in exchange for a 15% stake in his business – making this one of the highest value deals made in the shows long history.

Having lead a start-up through private fundraising rounds, Rob is no stranger to venture capital and equity financing. Further.Finance, his latest venture, offers a way for ordinary investors to get a piece of this fast-moving industry too.

Further review: A full review of the Further.Finance platform

A full Further review will be published after we’ve had a hands-on experience of the VC platform after launch. Until then, let’s explore the world of venture capital investments, and intermediary such as venture capital platforms.

Further review: investment opportunities

At any point in time, between 20 and 50 UK venture capital funds are launching or holding a new financing round. But this is only a small portion of the total VC fund universe. That’s because a single VC fund usually raises money for only a few months every few years. VC firms with a number of funds are able to offer investors at least one fund which is inviting new investment in a given month.

Why do VC funds opt to raise money through short fundraising windows? Because they want to be cash-rich and have surety over how much capital they have at their disposal to pursue deals. A competitive advantage that VC firms value is their ability to deploy cash quickly. VC firms don’t want to have to tap investors at short notice each time the VC partners believe they have an investment opportunity at their fingertips.

Further review: expected returns

Venture capital trusts could provide a return of up to 8.1% per year, after all, taxes and fees.

This makes the venture capital asset class one of the highest returning asset classes.

However, the performance of VC funds varies dramatically from fund to fund, and actual returns may vary significantly from the expected return.

An expected return figure is a useful indication of what a diversified investor could expect to return over the long return, based on how VC funds have returned to investors in the past. However, it is equally possible that an investor’s individual expectation varies from this average, or that venture capital as an asset class fails to repeat its strong performance over the last two decades.

This applies to venture capital investments made via a platform such as Further, or through other channels.

Further review: further platform functionality

Further offers a range of active VC fund or VCT options for investors to choose between. From the summary information on the platform, plus the information contained in the Key Information Document alongside each fund, you could learn:

- The VC fund name, together with the name of its promoter, investment manager, custodian

- The overall size of the fund

- The amount being raised this fundraising, and how much has already been raised to date.

- The track record of performance for the VC fund

- The sector or investment rules the VC partners will use as guiding principles

- Expected exit or capital return dates

- Information regarding any secondary market sale opportunities, if applicable.

Further review: tax benefits

Investors who choose to invest in a venture capital trust through platforms such as Further could see attractive tax benefits. The largest of which is a reduction in an income tax liability of up to 30% of the amount invested. In the right circumstances, this means that a £100,000 investment into venture capital trusts could only cost an investor £70,000 after the tax relief is considered.

The tax rules surrounding venture capital are complex, may change, and will have a different financial impact on different investors depending on their personal circumstances such as:

- Whether they are UK tax resident

- Their tax bracket

- Their annual income tax liability

It goes without saying that unless you are a sophisticated investor and are satisfied that you have read the HMRC guidance and fully understand VCT tax rules, you should consider finding a financial adviser and receiving tailored advice. A financial adviser could also help advise on the suitability of venture capital trusts in general for your investment objectives.

Income tax relief @ 30% of amount invested – Income tax relief of 30% on the first £200,000 of investments made into a VCT each year. This gives a maximum £60,000 discount on your UK tax liabilities. This relief can be offset against UK income tax in the year of investment or offset against tax paid for the year prior.

Tax-free dividends – Up to £200,000 of dividends received each year from VCTs will be exempt from personal income tax.

Corporation tax exemptions within the VCT – The VCT itself is exempt from corporation tax on the gains from disposing of holdings.

Capital Gains Tax (CGT) exemption – When you sell shares in a VCT, any gains made are exempt from capital gains tax (CGT).

When Further goes live, it will include a host of educational content such as videos and explainer guides which will help to demystify the tax rules around VC investments. However, this is not the same as financial advice, as it will not be tailored to the circumstances of any individual.

Further review: fees & charges

The fees charged by intermediaries and venture capital firms are not insignificant, however, they are often dwarfed by the size of the tax incentives on offer.

You could argue that the tax relief pays covers all investing fees and any leftover relief provides a discount on the investment. Again, this is highly dependent on the tax situation of the investor and financial advice should be considered.

In this Further review, let’s look at the fees you may have to pay as an investor.

An initial fee of 2.5% and above

The initial fee is charged to cover sale costs and initial administration and paperwork. Part of this fee is retained by the VC firm, and part is used to pay intermediaries (such as Further) for introducing clients to the VC fund. Whether you invest directly or via an intermediary, the initial fee charged is the same. This means it’s just as ‘cheap’ to invest through a platform such as Further, as it would be going direct.

An ongoing charge of 1.5% and above

An ongoing charge covers the salary and other costs of the venture capital team that pick investments, scrutinise deals and monitor the investment portfolio. This is labour-intensive work that requires other professional services (such as transaction support and legal support), which explains why this annual charge is justifiably higher than the management charge of a passive equity fund you might buy in your stocks & shares ISA.

Further: a summary

When it eventually comes to market, the Further venture capital platform offers the prospect of wider access to high risk VC investments. It will allow retail investors to tap into the private markets as a source of higher returns in a world of low interest rates.