Commodities are perhaps the most exclusive investments included in amateur portfolios. Opportunities can be notoriously difficult to find. But there are ways to do it without breaking the bank. This ultimate guide on how to invest in commodities will set out every method that investors use to access this exotic asset class. We’ll cover not just what you can invest in, but how.

What’s in this guide?

- What are Commodities?

- Why are Commodities Traded in the Financial Markets?

- How to Invest in Commodities

- How have Commodities Historically Performed?

- Which Commodities Protect against Inflation?

- Which Commodities have a Positive Expected Return?

- How should Commodities be used in a Portfolio?

- Summary & Quiz

What are commodities?

Unlike shares and bonds, commodities weren’t originally designed as an investment vehicle.

Most commodities by value are held not by investors, but by industry. They’re purchased as inputs into manufacturing supply chains. All commodities are physical goods that have a real use in the economy.

A common misconception is that commodities are just raw materials pulled out of the ground, such as oil and timber. Here’s a shortlist of commonly traded commodities to show the diversity:

| Gold | Aluminium | Coffee |

| Silver | Zinc | Cotton |

| Palladium | WTI Crude Oil | Sugar |

| Lithium | Brent Crude Oil | Frozen Orange Juice |

| Copper | Cocoa | Timber |

I’ve also pulled together a comprehensive list of commodities you can invest in.

All commodities have universal quality standards. Even an expert should find it difficult to distinguish between the quality or chemical composition of any two barrels of Brent crude oil, for example. This is because they are specifically manufactured or refined to meet a specific quality standard.

Why are commodities traded in the financial markets?

Some commodity investments can look complex or convoluted. To understand them, it’s useful to take a look at how the commodities market developed over time. The best commodities books will explain this far better than a blog post can, but here is an overview:

Forward contracts for physical delivery

Originally, the sole purpose of the commodities market was to match up producers of commodities with manufacturers who needed a stable supply.

Suppliers would write contracts which promised a given quantity of a commodity, to be delivered at a specific location (e.g. a port).

When a buyer purchased a contract, they were effectively placing an order for those goods. These are forward contracts.

If the buyer wanted to cancel the order, they would sell the forward contract to another buyer. This system ensured that suppliers could find buyers in advance, and buyers could change their mind without causing disruption.

Exchanging forwards well ahead of the date of delivery also meant that market participants were fixing their prices in advance. This allowed them to plan their pricing accordingly and maintain profit margins.

It wasn’t long before wealthy speculators saw an opportunity for financial gain. If they thought that the price of oil would soon rise, they might buy a contract to receive 1,000 barrels of oil, and sell the contract when the price rose.

By always selling the contracts before the delivery date, they never actually took delivery of any commodity. The transaction had become an entirely financial one.

Futures and options

As more and more investors entered the markets, separate ‘financial instruments’ were used in place of forward contracts. These carried names like Futures, Options and Swaps.

These are known as derivatives. They derive their value from the price of something else. In this case – a commodity.

This new breed of contract suited the speculators nicely. They were still written with standardised terms and conditions and could be traded, but they didn’t involve any physical delivery.

They are still the way that many speculators gain access to movements in the price of commodities.

Here’s how they work in a nutshell:

Where one party expects the price to go up, and one party expects the price to fall, both agree to exchange a sum of money at a future date to the side that ‘won the bet’.

This is a simplified view of how derivatives work. When one party makes a profit, the other has made a loss.

Using derivatives, investors can enjoy the benefits of buying or selling commodities without having to touch the real thing.

How to invest in commodities

As you would expect, over the last 100 years, various investment vehicles have emerged to help investors access commodities. The old methods still work too! Here’s a summary of the different ways you can invest:

- Buy shares in commodity Exchange Traded Funds (ETFs)

- Become a shareholder of a commodity producer

- Personally hold the physical commodity

- Pay an intermediary service to source and hold the commodity

- Use financial derivatives or spread betting

We advise that you follow our ultimate guide to spotting online investment scams to help you identify any red flags.

Read more: Options trading books

1. Buying shares in commodity Exchange Traded Funds (ETFs)

An ETF is a type of fund which is listed on the stock market. You invest by purchasing shares in the ETF through your carefully chosen stockbroker or stocks and shares ISA.

An ETF will use the funds collected from investors and will invest in commodities. Those investments come in two flavours; physical and synthetic.

As we explain in our guide on how to invest in gold; ‘Physical’ commodity ETFs will simply buy the commodity and hold it (or pay a trusted service to do so). The most famous physical ETF is the SPDR Gold Shares ETF (ticker: GLD) which manages approximately $30bn of gold bullion. It holds these as gold bars in London and other locations.

ETFs work using complicated processes to ensure their fund value remains consistent with the underlying holding of a commodity. This concerns some investors who only invest in opportunities that they understand.

‘Synthetic’ ETFs do not physically hold commodities, but instead, purchase derivatives to replicate the desired position. This introduces counterparty risk (the risk than the other party to the agreement fails to pay what is due). Such criticism has made these an unpopular form of ETF.

We’ve shortlisted the best UK stockbrokers that you could use to buy commodity ETFs:

Trade shares with zero commission. Open an account with just $100. High performance and useful friendly trading app. Other fees apply. For more information, visit etoro.com/trading/fees.

Large UK trading platform with a flat account fee and a free trade every month. Cheapest for investors with big pots.

The UK’s no. 1 investment platform for private investors. Boasting over £135bn in assets under administration and over 1.5m active clients. Best for funds.

Youinvest stocks & shares ISA offers lower prices the more you trade! Which? 'Recommended Provider' for last 3 years.

Choose a pre-made portfolio in minutes with Nutmeg. Choose your level of risk and let Nutmeg efficiently handle the rest.

Buy and sell funds at nil cost with Fidelity International, plus simple £10 trading fees for stocks & shares and ETFs.

Capital is at risk

Trade stocks & options on the advanced yet low-cost Freedom24 platform that arms retail investors with the tools to trade like professionals.

Capital is at risk

2. Becoming a shareholder of a commodity producer

This investment method provides indirect rather than direct exposure to a commodity price.

Commodity producers will enjoy high profits when commodity prices are high, and will generate poor revenues if the commodity price slumps.

On this basis, buying shares in a commodity producer can provide a ‘similar’ effect to investing directly in a commodity.

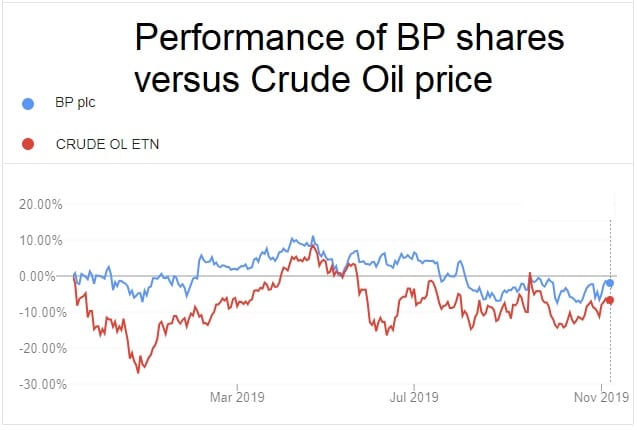

Take a look at the graph below, which compares the BP share price with an instrument that tracks the oil price, to see a real example of this relationship.

The advantage of sticking to company shares is that they are cheap to buy and easy to trade. The storage costs and tax issues of commodity ownership can be neatly sidestepped by avoiding real commodities altogether.

3. Direct investment

Let’s begin with the simplest method; buying and storing a commodity yourself.

This lends itself well to precious metals like gold, which is immensely valuable in small quantities.

Investors without an extensive warehouse to call their own might think twice before investing in oil. With a barrel of WTI crude costing just $56 at the time of writing, it would take a large facility to store even a modest delivery of the black stuff.

Tax rules can also throw a spanner in the works. If a UK investor wishes to buy silver, they will need to pay 20% VAT on top of the sale price. They will be unable to recoup this when they sell. This effectively imposes a 16% transaction fee on any personal silver investment, which makes it an inefficient way to invest in the metal.

4. Through an intermediary

For every tax problem, there is usually a solution. Investors who pay an intermediary in Switzerland to buy and hold silver on their behalf, do not need to pay VAT on the silver on the basis that it never leaves the Swiss bonded warehouse.

The benefits of professional storage reach far beyond tax loopholes. Other benefits include:

- No delivery fee for purchase or resale, as the product doesn’t move

- High security – precious metals are held in secure vaults and will be insured

- The service usually provides a facility to sell the investment back to them at a fair price when you wish to dispose of your holdings.

- Storage costs will be cheaper than holding the asset yourself, as the provider will enjoy economies of scale.

However, there are drawbacks to these services. Because investors never see their investment, an intermediary could be an online investment scam.

All respectable intermediaries will subject themselves to audits by a third party on a regular basis. But it can be difficult to verify these claims, particularly if the company is based in another country.

5. Using financial derivatives or spread betting

Professional trading platforms offer their clients the opportunity to trade a range of derivatives alongside ‘basic’ instruments like shares and bonds.

If you belong to such a platform, you could gain exposure to commodities by purchasing call options, or futures.

Read more: Books about derivatives

In this guide, I will explain how an option works:

How a commodity call option works:

With a call option, you pay a fixed premium to take a position. The key information that defines the option is the strike price and the expiry date.

If the price of the commodity is above the strike price on the expiry date, then you have won the bet. You will receive a payout for the price difference (between the live price and the strike price), multiplied by the number of options you bought.

If the commodity closes below the strike price, you lose, but your loss is limited to the premium you already paid.

Call options have unlimited upside and limited downside. Doesn’t that sound great? There is a catch of course – the use of a strike price tilts the odds in favour of the other party. This is why an option is will find two parties willing to take opposing sides – it’s designed to be a balanced bet.

For example, if oil trades at $50 per barrel, you might pay a $2 premium for an option with a strike price of $55 and an expiry date in 12 months.

If oil is trading at $60 on the expiry date, you would see a windfall of $5 per option. Minus the $2 it cost to buy the option, this gives a $3 profit on the trade.

If oil was trading at $54, the option would not payout, and you would have incurred a loss due to the premiums paid.

Spread betting can also be used in a similar way to earn profits from commodity price increases. See our investors guide to spread betting for our overview of this method.

How have commodities historically performed as an asset class?

Because commodities take many different forms, we need to pick a single commodity before we delve into historical performance. I will choose gold because this is the commodity favoured by investors.

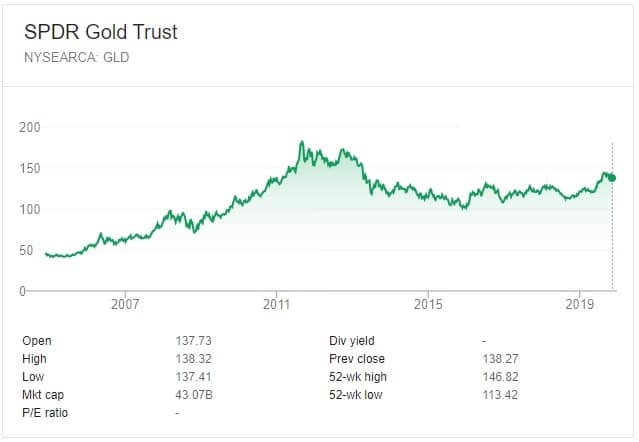

This is how the SPDR Gold Trust has performed since it was launched in 2004.

Its performance has been mixed. The first decade delivered gains of 350% to lucky investors who bought shares back in 2004. However, anyone who bought after 2010 has yet to see a profit even 10 years on.

The recent disappointing performance helps to underline a key problem facing commodity investors: commodities do not ‘generate’ a return.

Bonds are contracts which are designed to pay their investors interest. The management teams of listed companies are rewarded for increasing profits and paying dividends to shareholders.

In contrast, a gold coin sits on a shelf collecting dust. It only creates a profit if someone else is willing to pay more for your coin than you originally paid for it.

Commodity investors buy in the hope that demand will increase or supply will fall, increasing the price of the good.

With a rising global population and a growing global economy, it would be sensible to assume that demand will rise. However, the supply of some commodities is more flexible than you might think. At higher prices, some inefficient mines suddenly become economical. This means that supply also jumps up as demand rises – negating some of the price movement.

Which commodities provide the best protection against inflation?

Traditionally, precious metals (gold in particular) are viewed as an inflation hedge.

The idea is that gold has a relatively stable value. Therefore if inflation occurs, and each unit of currency now buys less, people will offer a higher price to buy the same amount of gold.

However, the same is true of all non-monetary assets.

In other words, as long as an asset represents a real-world item, such as shares, property and art, you are protected against inflation in this way.

I believe that gold is seen as the ultimate inflation hedge because of its historic uses as a currency stabiliser. In the distant past, governments would hold gold to act as a ‘backing’ for a currency to preserve its value. This practice has now ended, though.

However, conventional investing wisdom about gold (however wrong) cannot be ignored, because it guides the behaviour of investors in the market. This can create a self-fulfilling prophecy as follows:

Imagine if inflation expectations suddenly jump after the Bank of England announces an expansion to monetary easing (printing money). So long as investors view gold as an inflation hedge, demand for gold will rise, and so will the gold price. It’s a baffling state of affairs, but this actually happens.

Which commodities have a positive expected return?

Because commodities do not grow or provide a source of income, they do not have a positive expected return.

You will recall that in our explainer article about shares, we state that the value of a share is based upon its forecast future dividends.

Given that precious metals or barrels of oil do not produce an income, if we apply the same valuation approach, we calculate a value of nil.

It follows that similar to cryptocurrencies, there is no way to derive a ‘true’ value of commodities such as gold.

The price is merely a function of supply and demand.

Who demands gold? Well, manufacturers of electronics and jewellery need to source tonnes of gold each year. Central banks and private individuals who invest in commodities are also key buyers.

Who sells gold? Miners are the obvious answer, but recycling companies and existing investors also dump a huge volume of gold on the market each year. Because of its high value and stable chemical composition, gold is recycled rather than disposed. Most of the gold ever mined is still being used today.

Depending on the relative quantities demanded and supplied each day, the price will fluctuate accordingly. Whether this will be positive or not, cannot be predicted with certainty. History indeed shows us that the gold price can remain subdued for quite some time.

How should commodities be used in an investment portfolio?

This brings us to the ultimate question: do commodities have a place in investment portfolios?

The answer depends on who you ask.

Because commodities have no underlying expected return, their inclusion in any significant quantity will begin to reduce the calculated expected return of your portfolio.

Where I believe commodities can play a part is as a small allocation (i.e. 5%). If you carefully select commodities that have a negative correlation with the stock market, then it will act to diversify your holdings.

During the financial crisis, investors turned to gold as a ‘safe haven’. At the same moment, they were turning their backs on the stock market. This meant that a gold holding increased in value against the backdrop of sharp drops in equity indices worldwide.

This doesn’t answer the question of whether commodities are a safe investment, which is a topic I have explored separately. There’s also the question of whether commodities are suitable for beginner investors.

In conclusion, there are many ways as to how you can invest in commodities. Each comes with its own level of cost, convenience and efficiency.

Commodities might not have the high expected return of equities, but they are at best, a useful insurance policy which may reduce the volatility of your portfolio.

Course Progress

Learning Summary

How to Invest in Commodities

Commodities are materials and products which have a real use in the economy.

The value of a commodity is driven by the level of demand for it, compared to its scarcity.

Commonly traded commodities include oil, timber, gold and silver.

Commodities don't produce any income of their own, which means that they do not offer a positive expected return.

Their value to investors is primarily to stabilise a high-risk equity portfolio during a bear market.

Investors can gain exposure in five ways; personally buying, using a service, investing in ETFs, using derivatives or buying shares in producers.

Each method comes with a different level of cost. The larger the operation, the larger the economies of scale.

Investing indirectly into companies will mean your investment value will not necessarily track the underlying commodity price, but it should follow the trend.

Quiz

Next Article in Course

Before you move on, please leave a comment below to share your thoughts. I respond to all comments.