In this article, we will explore how to reduce the cost of investing can be reduced. Although this doesn’t sound exciting – reducing fees is actually the easiest way to increase your returns.

The Size of this Opportunity

Fee savings could make the difference as to whether you will achieve your investment goal.

If you invested £100,000 for 30 years at a net return of 6% (after 1.5% fees), this would grow to £574,000.

If you follow the steps in this article to design your portfolio, you could slash fees down to 0.5%; a reduction of 1%. This would increase your net return to 7%. After 30 years, your portfolio would instead be worth £761,000.

Not so boring now?

The Right Mindset: An Investing Cost is an Investment Loss

Expenses we incur whilst investing will eat away at our investment returns in the same way as an investment loss.

A 1% fee will have the same impact on your portfolio value, as the investments underperforming by 1%.

In the pursuit of greater returns, we should be challenging the value we receive for the fees we pay.

Particularly when we begin an investment portfolio, we may see upfront costs as an ‘investment’ for the long run. In doing so, we can rationalise high fees as a positive step to secure a brighter future.

This mindset is misguided. A cash outflow is only truly an investment if it generates its own return. What we must ask ourselves is:

“Does paying this fee promise me an increase in my returns, compared to options that would not incur a fee?”

If a lower-fee alternative is available which provides the same expected return, we have suffered. The premium that we paid was a luxury and will work against our investment objectives.

Fee Slashing is an Excellent Opportunity

If you read the small print of your broker and funds you invest in, you will understand the fees and charges upfront. This means that you can measure your savings easily when you make cost-cutting changes to your portfolio.

Because the fees would have definitely occurred, avoiding them is a guaranteed saving. This is a risk-free enhancement to your returns! Like the calculation in the introduction – you can calculate the potential wealth you have unlocked by taking action.

We will now walk through each type of fee incurred by investors, in two groups: Avoidable and Reducible.

How to Reduce the Cost of Investing – Avoidable Investment Fees

Financial Advice fees – Introduction

In the UK, the RDR regulations passed in December 2012 banned the practice of financial advisers sneakily collecting commissions from investment providers, as a reward for steering clients towards expensive products.

The improved model sees financial advisers charge a fixed fee or a variable fee charged as a % of the initial investment. The paperwork will clearly set out these fees. These will reduce the value of funds actually placed into the investments themselves. This removes the conflict of interest which previously existed and is a positive step.

However, a review by this website has concluded that advisers are poor at communicating their pricing structure on their websites. Many portals designed to match clients to advisers are completely silent on fees. This lack of transparency gives no incentive to advisers to cut their fees. Instead, this has more in common with other ‘hard-sell’ tactics door-to-door sales.

If you search for financial advisers online, your details will be passed onto the sales department of an advisory firm. This gives the upper hand to quick-talking sales agents who want to extract the maximum fees from you. This increases the likelihood that you will be ‘talked into’ paying high fees for basic investment products.

Financial Advice fees – When are they worthwhile?

Financial advice continues to be useful for individuals with complex investment needs. These include trusts and wills, complex tax affairs or high net worth individuals. It may take months or years of homework to become comfortable with the legal aspects involved in the above. Therefore taking advice is a simple step which ensures that all pitfalls have been considered and mitigated.

The vast majority of investing objectives, however, are simple in comparison. We have packed this website to the brim with useful knowledge to get you started. Anyone with a few spare hours can learn the basic skills needed to create a simple portfolio to achieve their goals

On that topic, consider reading further by exploring our book guides:

- The best retirement planning books

- The best portfolio management books

- The best financial independence books

For folks with simple circumstances and objectives, it’s usually not necessary to pay for bespoke advice on a one-to-one basis.

Even for those disinterested in making individual investing decisions – cheaper alternatives are now available in the form of ‘Robo-advisers’. Robo-advisers are online investment platforms that take care of all investing on your behalf. One questionnaire is all the platform needs to understand your investing risk appetite and investing time horizon and begin putting your funds to use.

Of course, independent professional financial advice remains a sensible backstop for those who feel ill-equipped to make financial decisions. Circumstances may also warrant the visible objectivity that a third party may bring to the situation. For example; when you are investing under power of attorney on behalf of someone else.

Financial Advice fees – How to reduce the cost of investing

You can totally avoid financial advice fees by operating your own investing account. This will entail investing in the stock market yourself either through a fund manager or a stockbroker.

It’s important to note that some fund managers and stockbrokers also charge fees for financial advice. For example, a quick browse through Fidelity’s website brought me to a retirement section which offered two types of advice. The first option was a free phone call to generally discuss their offerings. The second option was for personalised advice on transferring a pension for a whopping £3,500 fee. The fees were all clearly labelled though, and thus we can easily avoid.

Initial Fund Charges – Introduction

Upfront investment fees or front-end loads are one-off fees that mutual funds charge upfront. These can range from 0.5% to 5%.

An initial fund charge is worse than a financial advice fee, as the mutual fund offers no service in return. I’m reminded of casinos which ask members to pay entrance fees before they’re allowed onto the gambling floor.

Initial Fund Charges – When are they worthwhile?

An initial fund charge would only be worthwhile if the fund was the only way to gain access to a proprietary trading strategy which had demonstrated consistent outperformance. This is not true of any large scale mutual funds on the market today. Therefore, the practical answer is that these are never worthwhile.

Initial Fund Charges – What if I have Already Incurred A Charge?

Because the fund charge is a loss, rather than an investment, it should not factor into your forward-looking decisions. You have already paid the fee, and you will not see that money again. Therefore you should make future decisions completely blind to the fact that you have paid it. In finance jargon we refer to this as a sunk cost.

Don’t let an initial charge cause sway when other factors encourage you to ditch it for a better alternative. This is the behaviour of someone who is still viewing the fee as an investment rather than a loss.

This is a difficult truth for any investor to accept. Particularly if they have just paid £2,000 for the privilege of placing their money in a fund. If the investor were to immediately switch to another fund, the truth would be revealed. The investor has lost that portion of their investment. This can introduce emotional factors into the equation. A healthier mindset is to accept that what has gone has gone. All that can be done is to make the best investing decisions going forward to maximise your future return.

Initial Fund Charges – Personal Experience

In 2012 I was studying for a Financial Adviser qualification. I discovered that my Dad had paid for financial advice and had subsequent invested in an expensive fund. The fund charged an eye-watering 2% ongoing management charge for a basic equity and bonds investment strategy. I concluded that no informed person would have happily chosen this fund against similar, cheaper alternatives. Therefore to his dismay, I suggested that he transfer to a different fund which would save him 1.5% per year.

At this point, my father confessed that he had paid an initial charge of 3% to invest in the fund. This was, in fact, a combination of financial advice and fund charge. The 3% initial charge equated to a four-figure sum. My Dad found this to be a significant mental barrier against selling the fund. The adviser had encouraged him to think of the fee alongside the fund as part of a long term investment. In my Dad’s eyes, the fee would be a waste only if he left the fund in the short term.

Only after five years (and £1,000s in ongoing fees wasted) did I convince him to transfer to a low-cost option. This story serves as a tragic example of how one large fee can have a multiplier effect. It can distort our incentives and encourage emotional decision making.

Initial Fund Charges – How to reduce the cost of investing

Twenty years ago, in an era of low competition between fund providers, initial charges were commonplace. Investors accepted these as a necessary evil when these were the norm.

In the present day, I can gladly report that plenty of mutual fund managers no longer charge initial fees. As competition increases from other funds, managers are eradicating the practice. Exchange-Traded Funds (ETFs) for example, never charge a penny upfront.

As a result, you can find almost every investment strategy in a zero upfront fee fund. All that is needed is some quick fund research. Review the fee section of fund factsheets to understand the pricing structure of each fund.

Reducible Investment Fees

Ongoing Management Charges – Introduction

Ongoing Charges Figure (OCF) are the fees that fund managers charge on a quarterly or annual basis. As an investor, you are not personally billed these fees. The fund manager will deduct them from the assets within the fund instead. OCF is expressed as an annual % of the fund value, for example, 0.7%.

The main constituent of the OCF is the management charge. This is the fee that the fund manager receives as compensation for picking shares and administering the fund.

The OCF does not cover all costs incurred by the fund, notably, trading costs are not included. However, the management charge is by far the largest cost to a fund. Therefore, the OCF is a very useful measure for investors to scrutinise. It is the ‘headline’ measure of priciness.

Initial Fund Charges – How to reduce the cost of investing

The OCF of a fund is usually very constant year on year. Therefore, you can save costs by screening funds to excluding those with higher ongoing charges.

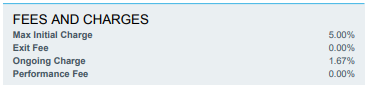

An example of an expensive fund is the Blackrock UK Fund Class A. The fee table in the fund factsheet is shown below. It discloses (in addition to a worrying 5% initial charge) an ongoing charge of 1.67%.

As a rule of thumb, funds that passively track an index such as the FTSE 100, have lower fees. You should be able to find many OCFs below 0.4%.

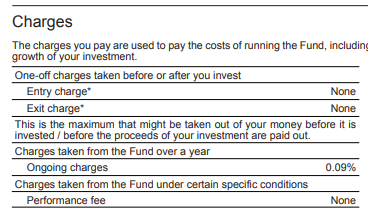

Vanguard has built its reputable upon low fees, and the table above underlines that point very nicely. The FTSE 100 UCITS ETF fund charges only 0.09% per year.

You read that correctly – the Vanguard equity fund charges less than a tenth of the Blackrock fund. The 1.57% fee saved each year could dramatically increase your portfolio value over the long term. Our opening example only used a fee saving of 1%!

Trading fees – Introduction

A trading fee is paid to a stockbroker to execute the buy or sale of a single class of shares.

If you plan to build a portfolio of individual companies, you will place many trades at the outset. As a reminder, to apply the science of diversification you should be aiming to diversify your portfolio across at least 20 different companies.

You will also incur trading costs each time you ‘top-up’ your investments with new money. You will also need to trade if you wish to rebalance (i.e. sell down existing holdings to buy other companies).

The smaller your portfolio, the greater the impact trading fees will have on your returns. This is because virtually all share dealing services charge a flat fee per trade. A trading fee of £10 will be barely noticeable on a purchase of £50,000 worth of shares. However, the same fee would siphon 20% of the value from a £50 investment!

Trading fees – How to reduce the cost of investing by picking the right broker

When researching stockbrokers – trading fees should be one of the primary factors you use to select your preferred platform. A quick Google will yield comparison tables that allow you to compare trading fees of many companies side by side. Companies with lower trading fees may have higher annual account charges (see ‘Platform fees’ next). Therefore, you should always weigh up the combination of these two charges.

Some stockbrokers offer lower trading fees for higher trading volume. For example, they may charge £12.99 per trade or £9.99 per trade if >10 trades are placed in a month. This is worthwhile to consider, particularly considering that you will be placing many trades to initially create your portfolio.

A word of warning. Many investors fall into the trap of over-estimating the number of trades they will perform on a monthly basis. Investors that are the most successful are often those that trade the least. Investors often realise this too late. Learn from this by paying more attention to the headline trade price for one trade.

Remember, cost isn’t everything. A broker could be cheap but the customer experiences of previous clients are also important, so search around. For example, Exness offered FX and other instruments for trading, but a quick read of the comments on this Exness review may give you a reason to exercise caution. At the time of writing, it no longer offers services to UK investors, but I thought this would serve as an example.

Trading fees – How to reduce the cost of investing by changing behaviour

The strategy for minimising costs is not to trade at high volumes to unlock advantageous rates. Rather, the winning strategy is to do as little trading as possible.

Again, like initial fund charges, trading fees are small ‘losses’ rather than investments. Aim to waste little money on trading fees to maximise the funds to be put into the shares themselves.

This can be done by staggering how funds are drip-fed into your shareholdings over time. A beginner may use 20 trades to split their monthly contribution across a portfolio of 20 companies every month. A smarter investor would feed it into a rotating list of 5 companies a month. Therefore, after 4 months, all holdings will have been topped up equally with 15 trades per month saved! Underpinning this strategy is a trade-off between minimising fees paid, and keeping shareholdings roughly even for diversification purposes. It is up to you to decide where to draw the line.

Many stockbrokers offer a useful ‘dividend reinvestment’ or ‘regular investment’ scheme. These give the broker permission to automatically invest loose cash into specific holdings each month. The trades are typically at a heavily discounted rate. This is because the broker will aggregate your trade with thousands of other investors. This rate can be as low as £0.99 (Interactive Investors) – which is a huge saving. Look into whether your preferred broker offers a similar regular investment scheme.

Platform Fees – Introduction

Whether you invest in a full-service stockbroker account, a share dealing service, or a fund supermarket, you will pay an account or platform fee.

Intermediaries such as stockbrokers also used to collect referral commissions from funds, in a similar way to advisers. After the RDR regulations came in effect, investing platforms needed to replace that lost source of income with another charge. This charge became the ‘platform fee’.

The fee is recurring and is either a flat fee or is based on a % of your assets. Higher value portfolios typically attract reduced % rates.

Platform Fees – How to reduce the cost of investing

Once within a stockbroker account, the platform fees will be either fixed or will cover all assets. This makes it virtually impossible to reduce the fee through a change in behaviour.

The entire industry has moved in step by introducing platform fees, particularly for stocks & shares ISA accounts. However, some providers do provide zero fee accounts, therefore, consumer research will be well rewarded.

To make sense of charges, it is important to forecast how many trades you will place each month. Use this to calculate an annual broker cost, including both platform and trading fees.

Halifax has platform fees of £nil for a non-ISA, but its trading fee of £12.50 is not very competitive.

In contrast, Interactive Investor charges a £9.99 platform fee for non-ISAs, however its trading fee is only £7.99. This means that investors expecting to place more than three trades would find Interactive Investor the cheapest choice.

Stamp Duty – Introduction

HMRC charges stamp duty of 0.5% on all trades of company shares. Stockbrokers collect the stamp duty when you place a trade.

Investors must accept this as a cost of trading. Because the stamp duty rate is the same regardless of what broker is used, this cannot be avoided.

Investment into funds do not attract stamp duty. However, what many investors fail to realise is that the funds themselves pay stamp duty on each purchase they make. These costs are ultimately passed onto investors through reduced returns, therefore stamp duty is still incurred.

Stamp Duty – How to reduce the cost of investing

A tip to reduce the impact of stamp duty is to review the costs of trading reported by funds. The trading patterns of funds can differ wildly, even if their names or investing strategies sound similar. Some funds may buy and sell companies rapidly and continuously ‘churn’ their investment positions. On the other hand, funds which track an index will only trade to replicate any changes in the underlying index. They will also trade to buy and sell holdings as capital enters or leaves the fund.

Stamp duty is not included in the ongoing charge figure (OCF) reported by the fund. Trading costs are therefore another useful indicator of the true cost-base of a fund. This should only be a secondary factor in evaluating funds, as the OCF and other measures have a larger impact.

Value Added Tax – Introduction

Value Added Tax or VAT is the consumption tax paid on goods and services across the European Union. In the UK the headline rate is 20%. The following investments are either completely exempt or ‘zero-rated’ from VAT which means that no VAT is charged:

- Shares

- Bonds

- Funds

- Currencies

- Gold bullion

- Residential property

This list includes many of the investments of choice for British investors. Therefore it is safe to say that many investors don’t encounter much VAT (except on broker fees and similar services). Therefore I was tempted to not include VAT at all in this guide on how to reduce the cost of investing.

Of course, as any business book or management book will make clear, VAT is a much larger issue for institutions that manage our money than it is for individual investors.

However, there is one notable exception which is worthwhile highlighting:

- Silver bullion is subject to VAT.

If you bought silver on Monday and sold it on Tuesday, you would have lost 16.7% of your investment. This is due to the 20% VAT mark-up you had paid to HMRC on top of the real silver price.

The inclusion of VAT on the sale of any silver bullion products effectively acts like a 16.7% initial investment fee. This makes straightforward investments in physical silver deeply unattractive to British investors.

Some silver dealers have devised an alternative way to invest in silver to avoid VAT. BullionbyPost customers can request ‘delivery to storage’. If buyers take advantage of this option, BullionByPost will not charge VAT.

This takes advantage of a loophole in international law. In the case of BullionByPost, they store the silver in Switzerland. Switzerland is technically outside of the EU, and therefore this evades the tax. You will need to place great trust in the reputation of any provider which offers this service. This is because you will see very little evidence that your investment indeed exists. Gold selling companies are also not as regulated as investment firms.

Course Progress

Learning Summary

How to Reduce or Eliminate the Cost of Investing

An investing cost is an investment loss. Apply scepticism to every fee you incur and challenge whether you can pay less.

Cost-cutting is an unbeatable strategy to increase your portfolio value. Lower fees is a higher return without higher risk. Like diversification, it's a no brainer.

Independent financial advice is an expensive product. Simple financial circumstances only require a simple investing strategy. Therefore before you choose to hire an IFA, invest a few hours in books or an online course. You may find that you are confident enough to reconsider whether advice is necessary after you have demystified the subject.

Never pay an 'upfront' or initial investment fee to access a fund. You can always avoid these by shopping around for alternative funds.

Compare the annual Ongoing Charge Figure % (OCF) to ensure that your target fund is competitive. We recommend you benchmark against Vanguard funds as they typically have the lowest fees.

When researching stockbrokers, consider your trading frequency. Use this to calculate a total trading and platform fee. This will give a realistic basis to compare the true cost of platforms.

Quiz

Take Action

- If you are new to investing - use the tips in this article to analyse funds and investment platforms as you choose them. Use price comparison services to help you compare costs, however be aware that many comparison sites exclude platforms which refuse to pay them. The irony is that those are most likely to be the cheapest brokers!

- If you are new to investing - use the tips in this article to analyse funds and investment platforms as you choose them. Use price comparison services to help you compare costs, however be aware that many comparison sites exclude platforms which refuse to pay them. The irony is that the excluded platforms are likely to be the cheapest!

Next Article in the Course

Before you move on, please leave a comment below to share your thoughts. What costs have had success in cutting in the past?