About the My Portfolio series

My Portfolio is a series of blog posts which share the secrets of my own investment portfolio. These will give you the opportunity to peek at the logic behind my biggest investment decisions.

The free investing courses on Financial Expert cover a lot of theory about the steps you should take when creating a portfolio of your own.

But when learning any rules for the first time, I believe it can be really helpful to see real examples first, before having a go yourself.

As the phrase goes – “I am unique, just like everyone else!” My portfolio reflects this maxim. This means that my investment approach may not be a close fit for you.

But I ask you to take take a look. See what I’ve done ‘differently’ to the basic portfolio examples I included in the course. It might give you some inspiration on how you can tailor your own portfolio to your needs.

My Asset Allocation

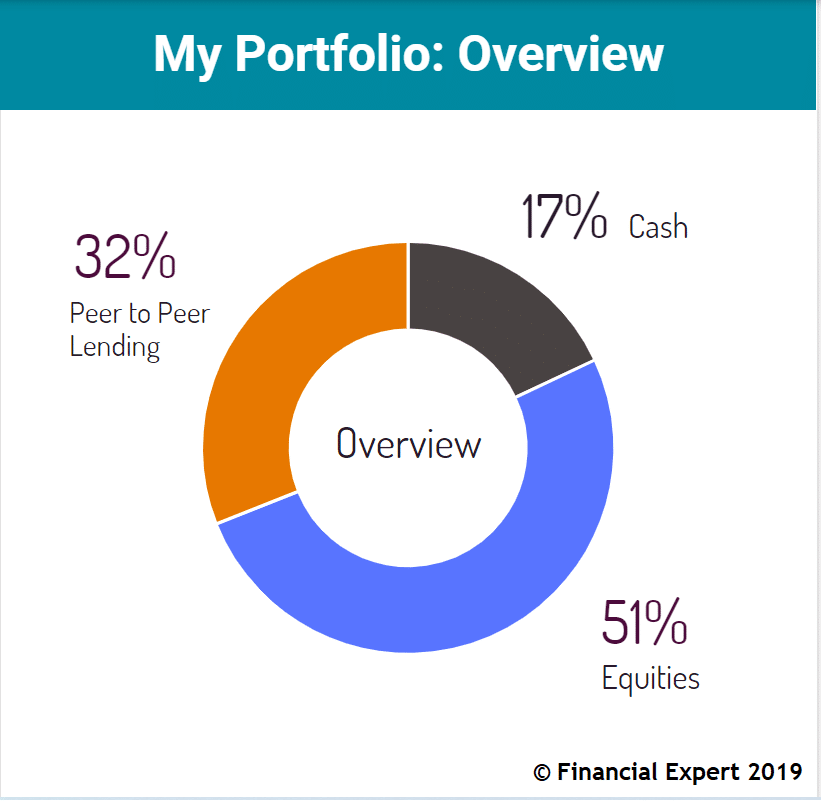

Half of my portfolio is shares, a third is spread across peer-to-peer lending platforms, and the remainder sits in cash.

In this article, I’ll explain why I designed my portfolio in this way.

Leveraging the powerhouse asset class

The first thing you’ll notice is that the majority of my portfolio is equities.

Equities are the highest risk, and highest returning asset class. Therefore it should come as no surprise that I used them to form the solid ‘core’ of my portfolio.

This increases my returns but increases the risk.

There was plenty of room to increase the equities allocation further still, however, I did not want the additional risk.

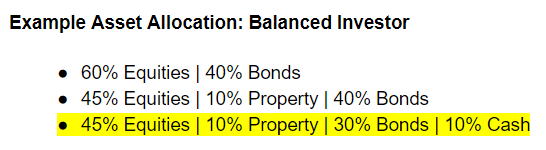

In our portfolio guide, we suggest that an allocation of 50% to equities matches a ‘Balanced’ risk profile. My portfolio is closest to the yellow example below.

When I complete my risk appetite questionnaire, I actually get the highest result; ‘Adventurous’. On reflection, this raises a valid point that my portfolio is probably more cautious than I need to it be.

If I upped equities from 50% to 60%, I would increase my expected return further, but stay within my tolerance.

Where’s the property?

A glance at the pie chart reveals that I haven’t invested in property at all.

Why is that?

Well, part of the answer is that I expect to be buying a house in a few months time. Therefore my appetite to invest in property is subdued by that upcoming purchase.

The other reason is that my portfolio has more exposure to property than you might first expect.

Many of my peer to peer loans are backed by property as security, or are being lent to fund property development. The interest that I receive will always be capped by the interest rate on the loan.

However, the performance of these loans are still linked, indirectly, to the performance of the stock market.

If the housing market were to crash, property loans would default at a higher rate, and the value of the security will fall. This will lead to higher losses on the loans.

If I were to invest 10% of my portfolio into other property investments, this direct exposure, plus the hidden exposure in my peer-to-peer lending, would leave me very exposed to a property market slump.

If I had used corporate bonds instead of peer-to-peer lending, I wouldn’t have had this same issue. Which brings us to the next topic:

Peer to peer (P2P) lending versus bonds

Like many investment portfolios, mine has a stabilising debt-based asset class.

You will notice that rather than using corporate bonds to perform this role, I use peer to peer lending platforms instead to invest my money from photography.

This is because of the following advantages that P2P investing has over corporate bonds:

1. P2P offers higher yields compared to corporate bonds

Due to historically low interest rates in many countries around the world, the yields of corporate bonds have also been pushed lower.

The Vanguard Global Bond Index fund yields just 1.7%.

For a personal investor, this is hardly worth the effort and risk. You could easily earn 1.7% risk-free from a savings account!

Peer to peer lending to individuals with a good credit score can yield 4 – 5%, after bad debts.

This rate isn’t assured, as a recession will lead to higher bad debts. However corporate bonds aren’t without risk either.

However, unlike corporate bonds, P2P delivers a yield right at the sweet spot. I hope it will be a very useful stabilising asset in my portfolio.

2. P2P offers a stable capital value

The ‘price’ of a P2P investment remains fixed through the life of a loan. If I were to sell/withdraw a loan halfway through, I can expect to receive my money back in full.

The price of corporate bonds, on the other hand, fluctuate on a daily basis. Factors which cause price swings include

- Changes to the creditworthiness of companies; and

- Changes in general interest rate expectations.

This introduces a ‘price risk’ which doesn’t exist for P2P investments during normal economic conditions.

Plenty of cash

At the beginning of the Foundation investing course, I explain why I believe that cash savings accounts are terrible long term investments.

Yet my generous 17% allocation to cash isn’t the shocking U-turn it appears to be. It’s just the application of another golden rule.

And that rule is – ‘always consider your investment time horizon‘.

At the time of writing, I’m expecting to buy a house in one years time. Therefore, the lump of savings that I’ll be using to fund the deposit cannot be invested in shares or any other long term investment.

If I placed my deposit into a Stocks and Shares ISA for the next twelve months, I might set myself up for the highest ‘expected return’ on average.

However, the actual return over a one year period would be very volatile. I would have a roughly 30% chance of receiving a negative return. This could mean that my deposit is no longer sufficient to cover the amount needed. This is precisely why a bank account is the right place to keep it.

Not too controversial

So there you have it – my asset allocation can be explained in just three colours. By keeping my portfolio simple, I make it easy to visualise and stick to my investment strategy.

You can read more about asset allocation using my shortlist of the best asset allocation books.

Want to look closer? In my next article, I’ll show you how I picked individual investments within each asset class.