In a financial landscape where every percentage point counts, understanding and navigating high-yield savings accounts is essential for anyone looking to grow their savings efficiently. At the heart of this journey is the concept of Annual Percentage Yield (APY), a critical factor that determines the growth rate of your savings. This article aims to guide you through the intricacies of APY, highlighting its importance in high-yield savings accounts and providing insights on how to maximize your returns. Whether you are a novice saver or a seasoned financial enthusiast, this exploration into the world of APY and high-yield savings will equip you with the knowledge to make more informed and profitable savings decisions.

In the quest for financial stability and growth, high-yield savings accounts have emerged as a beacon for savers seeking to maximize their returns. Central to understanding these accounts is the concept of Annual Percentage Yield (APY), a key metric that determines how much your savings will grow over time. This article delves into the world of high-yield savings accounts, unraveling the significance of APY and guiding you on how to navigate these waters to secure the best possible returns on your savings.

Understanding APY in High-Yield Savings Accounts

Annual Percentage Yield (APY) is a measure that reflects the real rate of return on your savings, accounting for the effect of compounding interest. Unlike simple interest, which is calculated only on the principal amount, compounding interest is calculated on the principal and also on the accumulated interest over previous periods. This makes APY a more accurate measure of how much you will earn or owe in a year.

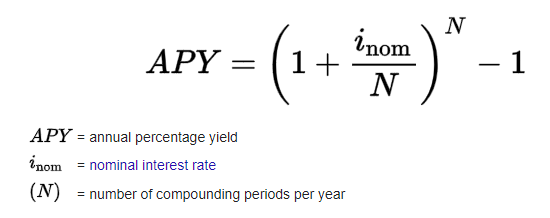

The formula for APY is:

The higher the number of compounding periods, the higher the APY will be, assuming the same annual interest rate.

For a practical understanding of how APY works and to calculate it for different scenarios, using an APY calculator can be incredibly helpful. This tool simplifies the process, allowing you to input different variables and instantly see the potential yield.

The Importance of APY in High-Yield Savings

APY is a critical tool for comparing different savings and investment products. It provides a standardized way to compare the potential returns from different accounts, regardless of their compounding periods. This is particularly useful when you’re comparing high-yield savings accounts, which often offer more attractive interest rates compared to traditional savings accounts.

Factors Influencing APY in High-Yield Savings

Several factors can influence the APY of a high-yield savings account:

- Interest Rate: The base interest rate is a primary factor in determining APY.

- Compounding Frequency: The more frequently interest is compounded, the higher the APY.

- Bank Policies: Different banks have different policies regarding interest rates and compounding, which can affect the APY.

- Economic Conditions: Wider economic conditions, such as the federal interest rate, can influence the APY offered by banks.

Choosing the Right High-Yield Savings Account

When selecting a high-yield savings account, it’s essential to consider the APY. However, it shouldn’t be the only factor. Consider other aspects like fees, minimum balance requirements, and the institution’s reputation.

APY vs. APR in Savings

It’s important not to confuse APY with Annual Percentage Rate (APR). While APY reflects the total amount of interest earned on an investment or paid on a loan, including compounding, APR represents the annual rate charged for borrowing or earned through an investment without taking compounding into account.

Maximizing Your Returns with High-Yield Savings Accounts

To maximize your returns in a high-yield savings account, focus on accounts with the highest APY. However, be mindful of any potential fees or restrictions that might be attached to these accounts. Regularly monitoring your account and staying informed about rate changes can also help you maintain the best possible yield.