Welcome to Financial Expert. If you’re at the crossroads of choosing between a savings account or investments, you’re in the right place.

In fact, this article might just change your life for the better.

This single decision could unlock the financial freedom you need to pursue your goals in life.

An excellent investment decision could bring your retirement date forward by several years.

Beating the savers dilemma

To do so, you’ll first need to beat the savers’ dilemma. This is my name for an uphill battle that you will face as a saver.

This ancient foe could place a huge drag on your personal wealth. It inspired me to create a free source of investing courses; the website you’re on right now! And it has nothing to do with whether you understand how to save money in the first place.

What is it?

The savers’ dilemma is an uncomfortable revelation about savings accounts: they won’t make you any richer.

That sounds controversial. I’ll explain exactly what I mean.

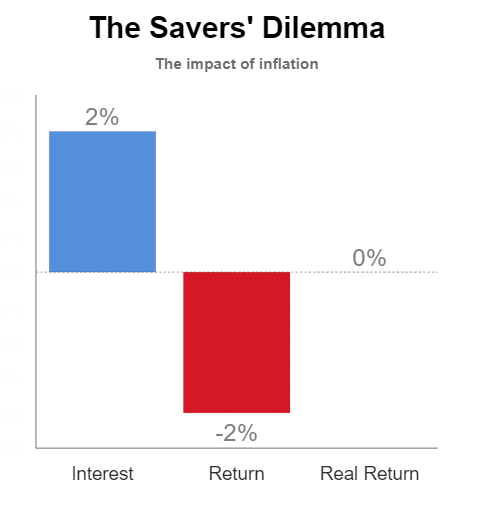

In 2020, the best UK savings accounts pay an interest rate of 2%. However, the inflation rate is also 2%.

At the end of a year, a lump of savings will only buy the same goods and services as it could at the beginning.

You, as a saver, have seen no financial benefit in return for your patience. Now that’s a depressing thought.

As the dilemma sinks in, you may feel pangs of regret. I wouldn’t be surprised if you even felt a bit misled by whoever who taught you about money as you were growing up.

Savers aren’t winning

Hang on a minute… isn’t interest supposed to offer you a real reward in exchange for locking your money away for a year?

Isn’t it supposed to grow your savings to help you reach lofty financial goals?

And what about the snowball effect; the idea that compound interest has a vast impact when savings are put in a bank account for years and years?

The answer is unfortunately that this is all meaningless waffle when applied to savings accounts.

Interest income does benefit from a snowball effect… but so does inflation.

As interest rates rarely exceed inflation, this equation doesn’t change even when you look at the maths over long periods of time.

To illustrate, back in 2007 interest rates were at their highest levels in a generation (4-5% on fixed-term savings accounts). Want to guess what the inflation rate was?

4%. Also its highest in a generation.

This isn’t a coincidence. Interest rates and price increases are actually connected. Interest rates usually only rise because inflation has also risen. I won’t delve into the technical reasons why in this article! Browse the best economics books and the best finance books for more information.

The bottom line is that your savings’ buying power will only grow if the real interest rate (the rate exceeding inflation) is positive. When interest rates and inflation are similar, the real interest rate is 0%.

From zero to great in 4 steps

So how can you generate a real return on your money?

- Accept that the savers’ dilemma exists and that savings accounts alone are not the answer.

- Educate yourself about investing and gradually build your financial confidence.

- Plan for your circumstances and consider taking professional advice.

- Create and invest in your own basic investment portfolio.

You’re already on track

Here’s the good news: you now understand the savers’ dilemma. Tick.

You are also in the right place for Step 2: Educate.

I created the Foundation Investing Course (This is lesson one) to explain how you can become an investor, and how to decide whether investing is right for you.

Let’s begin

So, now that you’ve read about the savers’ dilemma, a 2% interest rate now feels like a poor deal. But what are your other options?

I’m of course talking about investing. How do other investment alternatives stack up against putting money in a bank?

And when other factors are considered such as overall risk, does the humble bank account manage to redeem itself? Read on to find out.

The alternatives to savings accounts

Beyond banking, the core investment options are:

Equities (Also known as stocks and shares). Equities give you partial ownership of a company. This entitles you to a share of future dividend payments it makes to shareholders out of its profits. Investors in the UK tend to hold equities within a stocks & shares ISA.

- Shares listed on the stock market

- Shares in unlisted private companies

- Units in a fund which invests in companies on your behalf

Debt. The right to be repaid a specific sum, plus interest at a later date.

Property. Possession of title over an area of land, or the buildings upon it.

- Private investment in land

- Investing in property (such as ‘buy to let’)

Commodities & other assets. Ownership of other items which may not produce an ‘income’, but whose value may rise over time.

- Gold

- Collectables, such as wine, art and classic cars

We’ve produced a comprehensive list of everything you can invest in, together with suggestions on how to find the best companies to invest in and the best funds to invest in. If you’re stuck for ideas and are looking for a place to help you brainstorm. These can be useful.

Let’s head to class

These investment types are called ‘asset classes‘. Asset class are groups of investments with similar characteristics such as risk and reward.

These alternatives to bank accounts all offer the opportunity to protect wealth and even grow it over time.

Let’s focus on equities. How do these compare against saving in a bank account?

Comparing the performance: savings versus investing in shares

The table below shows the annual gain or loss in the total value of the 100 largest companies on the London Stock Exchange (known collectively as ‘The FTSE 100’).

If you had invested £1,000 in those same companies in 2010, this would now be worth £1,579. That’s an average return of 6.7% per year!

Meanwhile, £1,000 placed in a best buy 2% savings account for the same period would have only grown to £1,148.

Is that a fair comparison? Or have I chosen a time period which is skewed in favour of investing?

To find out, we need to look over a much longer period. Credit Suisse, an investment bank, has crunched data which shows that over the last 118 years UK equities have returned an average of 5.5%.

This is slightly lower than recent experience, but it still paints a clear picture of outperformance.

But what about the risks?

If you’ve heard anything about the stock market, it’ll be that the stock market is a risky business.

But is that true?

The straightforward answer is yes – but that’s an answer so simple that it hides the truth. The level of risk actually falls dramatically if you can invest for a long period of time.

The price of any share could fall tomorrow. Share prices fluctuate daily, resulting in good news for investors on some days and bad news on others. Even for seasoned investors, this can be difficult to stomach.

This risk transforms into a dramatic headline when rare stock market crashes occur. This is when shares lose a significant fraction of their value over a handful of days. For example, on 6 November 2008 during the height of the Financial Crisis, the FTSE 100 fell by 5.7% in a single day.

Putting risk into perspective

If you would be upset with a financial loss in the short term, then owning shares might not be right for you.

That risk can never be fully eliminated. As you will learn in later articles in the Foundation Course, it is precisely this risk which causes high returns. You can’t have one without the other.

As any business book will tell you, risk is ultimately the source of reward. It’s impossible generate a lucrative return in a risk-free fashion in a competitive market.

Use our ‘Investing Risk Appetite Questionnaire‘ to understand your tolerance to risk and discover how you can change your investment strategy to suit.

A wise shareholder does not need to pray for an unbroken string of gains. They accept that share prices will ebb and flow like waves crashing on a beach.

They understand that long term returns are more like the creeping tide; it might be difficult to perceive against the thrashing waves, but it will nevertheless have the most lasting effect on the shoreline.

It is when viewed over long periods, that shares begin to look like a stable and reliable investment.

In the UK, for instance, the stock market as a whole has never lost value over any 25 year period (source). It’s perhaps worth repeating that again:

The UK stock market has never fallen over a 25 year period.

This track record makes shares a popular choice for retirement funds and other long term saving goals. The length of time you can invest over, known as your ‘time horizon‘, is a critical concept which we cover later in the course.

Why do people fail to invest?

Crash anxiety from 2008. A survey conducted by Gallop in 2018 (source) revealed that only 37% of under-35s in the US were invested in stocks and shares, compared to 52% in 2007 ahead of the stock market crash which occurred during the financial crisis.

The stock market crash during 2008-2009 acted as a deterrent to young investors.

What isn’t widely reported is that despite the crash, the US stock market has still delivered an impressive performance. Even if you include the effect of the crash, US shares have gained 8.2% per year since 2007 (source).

A lack of confidence. Investing concepts can be difficult to grasp, and it is easy to lose yourself in a sea of acronyms and jargon.

This confusion works to the benefit of active fund managers and financial advisers, who earn commissions and fees from investors who don’t feel equipped to make investment decisions on their own.

For some – delegating this mental effort is a conscious choice they are happy to make. For others – it feels like the only option, despite a nagging feeling that they are being taken advantage of.

Tragically, a final group decides that the smoke and mirrors of the stock market make savings accounts the only rationale choice after pondering ‘should I save, or should I invest?’.

This website was created to balance the equation and provide more people with access to sound investing principles to help guide them to make better choices.

The costly mistake most of us make

If I asked you to visualise what a disastrous investment decision might look like – what comes to mind? A retiree conned into placing their life savings into a worthless company? Or perhaps a naive investor buying shares in a company the day before it files for bankruptcy?

These types of mistakes are both rare and avoidable. Instead, let me paint you an alternative picture. Here’s a horrifically expensive investing decision that millions are making:

Imagine having £250 to save each month for 30 years, but deciding at the age of 25 to put it in a savings account rather than building a basic investment portfolio.

In a 2% bank account, those payments over the years would have grown to £123,000.

However, had they placed this in the stock market and generated a typical return of 6%, that £90,000 would be worth £244,800.

The bank saver missed out on £121,800! Can you imagine the ecstatic celebration of a contestant on Who Wants to be a Millionaire winning £125,000? This is the prize on offer to anyone saving £250 per month.

Are shares the solution to poor savings returns?

So far, I’ve explained that equities have reliably outperformed savings accounts over long periods.

However, I have also highlighted that shares bring risks such as short term price instability.

The question of whether shares are appropriate for your circumstances, and what portion of your money you should invest, depends upon factors such as:

- Your risk tolerance

- Your personal circumstances

- Your investing time horizon

And more! I will explore each of these points in order and reveal how to build an effective investment portfolio over the rest of the foundation course. Please navigate to the next article and join me there!

Course Progress

Learning Summary

Should I Save or Invest?

Savings accounts pay tiny rate of return which cannnot keep up with increases in the cost of living.

There are several alternatives to saving, such as investing in property, shares or bonds. Some of these investments can generate returns of over 6% per year.

Shares are the most popular form of investing and have returned 5.5% annually over the last century and 6.7% over the last decade.

Shares carry a risk of price swings, which may make owning shares quite stressful. Shares are inappropriate investments for individuals with an aversion to risk, or who have only a short period to invest.

However, such swings are only temporary. Over any period of 25 years, a basket of UK shares has always been worth more at the end compared to the beginning.

A saver who can invest £250 per month for 30 years, will likely earn £100,000+ more if they invest it in the stock market rather than a savings account. A life-changing amount of money is at stake.

Therefore as part of a balanced portfolio, it will be hugely beneficial to your retirement date and quality of life, if you can invest rather than save in a bank account.

Quiz

Take Action

- Use this savings calculator to quantify the upside of switching from a 1.5% savings account to a 6% investment portfolio over your savings period.

- Visualise the impact that additional wealth would have on your quality of life. This could be the beginning of an exciting journey!

Next Article in Course

Before you move on, please leave a comment below to share your thoughts. What rate of interest do you earn on your savings account? Do you feel it's a fair reward?

Comments 6

Pingback: More Than Discounts: 3 Advantages Of Cheap Train Tickets - Financial Expert™

Pingback: How to Save for a House Deposit - The Ultimate Guide - Financial Expert™

Pingback: 83% of parents are saving for their children in cash, but it might not be a good idea

Pingback: 83% of parents are saving for their children in cash, but it might not be a good idea | Talking Finances

Pingback: How to Begin Saving For Your First Home - Financial Expert™

Pingback: What is Corporate Investing? - Financial Expert™