There are 149 million square kilometres of land on this planet. That’s 20,000 square metres per person. Do you personally own your fair share?

I have created the ultimate guide on how to invest in land to help spread useful information about this well-known but rarely-used asset class.

Investments in land can be lucrative, but you will generate those returns in a different way to investments in property. Land investments also bring their own range of pitfalls.

Some readers might be lucky enough to already own a home. The experience of buying a house will arm you with some transferable knowledge.

But you might be surprised to hear that knowing how to invest in property won’t get you very far in the world of land investment.

This guide will explain the risk, rewards and ‘the way things are done’ in the land investment industry. I have tailored the information to a UK audience. Please read this important disclaimer, which explains that this article does not replace professional financial advice.

What’s in this guide?

Why is land an attractive investment?

Land is the ultimate scarce resource. Its price continues to appreciate because the demand for land is relentless, and nobody is making any more of it.

We need land to live, to work and to enjoy ourselves. As the population grows, the demand for land grows with it.

The Office for National Statistics predicts that the UK population will grow from 63,000,000 to 74,000,000 people over the next 25 years. More people will need more houses.

As a reaction to increasing land costs, architects are turning to the skies and building upwards. Adding floors will maximise the value of a building and minimises its footprint. It’s expensive, though. It’s far more cost-effective to develop unused land when building outside of city centres.

The ‘land cycle’ that sees builders acquiring, building then selling is the engine of the land investment industry. Successful land investors are those who can source and sell:

- the right type of land

- to the right land buyer

- at the right time

A strategic opportunity

The largest land buyers are the housebuilders. The largest include names such as Barratt Homes, Taylor Wimpey, Persimmon, Kier Living, Bellway and Galliard Homes.

These companies maintain ‘land banks’ which hold land back for future projects. A land bank secures a builder’s future pipeline of projects and protects them from turbulence in land prices.

The scale of these land banks is staggering. The Telegraph reported in April 2019 that the top 9 builders held 800,000 land plots between them.

For context, the whole construction industry built just 170,000 properties in the year to June 2019. This reveals the hoarding mentality of the average housebuilder.

As they continue to add to their land banks, investors can earn a good return selling land to the construction giants.

Housebuilders have always blamed a restrictive planning system for the low supply of housing. This creates an opportunity for investors to add value to their land by obtaining the relevant residential planning permissions before they sell up.

Plenty of room

With 800,000+ plots of land already in the clutches of large builders, you might be forgiven for assuming that all the good land is gone.

But this simply isn’t the case. I was surprised to recently learn that only 6.8% of the UK is ‘urban’. We tend to overestimate the coverage of urban areas because it’s where we spend most of our time.

Far from being paved over – almost 19 in every 20 square kilometres of British land is rural. If the country were a dartboard, you’d be hitting green almost every time a dart landed.

Flexibility

Land is a very flexible investment. Raw land has few overhead costs and doesn’t require ongoing ‘maintenance’ as a building would.

Indeed, the internationally accepted accounting rules prohibit a company from ‘depreciating’ land (writing down its value over time. In contrast, companies write down investments in bricks and mortar over 25 – 50 years. Even the cautious beancounters assume that land will hold its value indefinitely.

This gives investors a range of options:

- If they bought it at a bargain price, they can try to ‘flip’ the land, i.e. place it back on the market and patiently wait for a higher price.

- They can develop or improve the land to add value.

- Purchasing adjoining land could create a larger plot worth more than the sum of its parts.

- Finally, investors could be passive and simply wait. Nearby developments or improving economic conditions could result in the land value rising over the long term.

How to find land available for sale

You are unlikely to find parcels of land plastered in the window of a local estate agent. You can find it through these different channels:

Land brokers/ land agents

Land brokers act as agent/consultant to the land industry. They work with land investors and land buyers to add value and facilitate transactions.

This means that land brokers offer land for sale, on behalf of their client base.

Alternatively, a land broker could assist your search effort to locate a piece of land that meets your exacting specifications.

Like estate agents, land brokers charge fees for their services. Depending on the service, they may charge a % of the transaction value, or invoice separately.

Portals

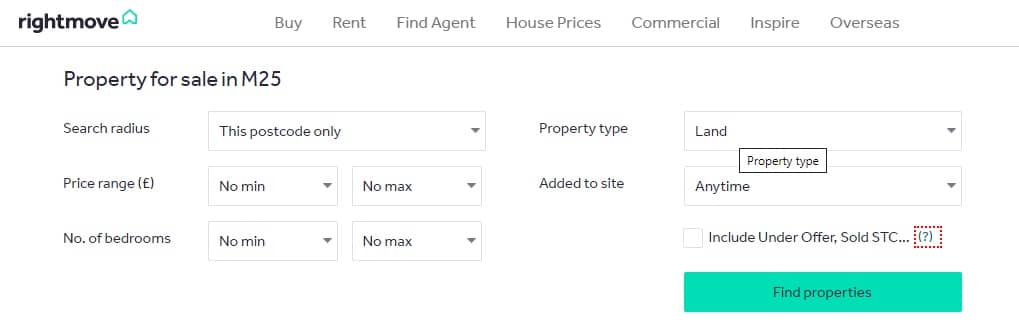

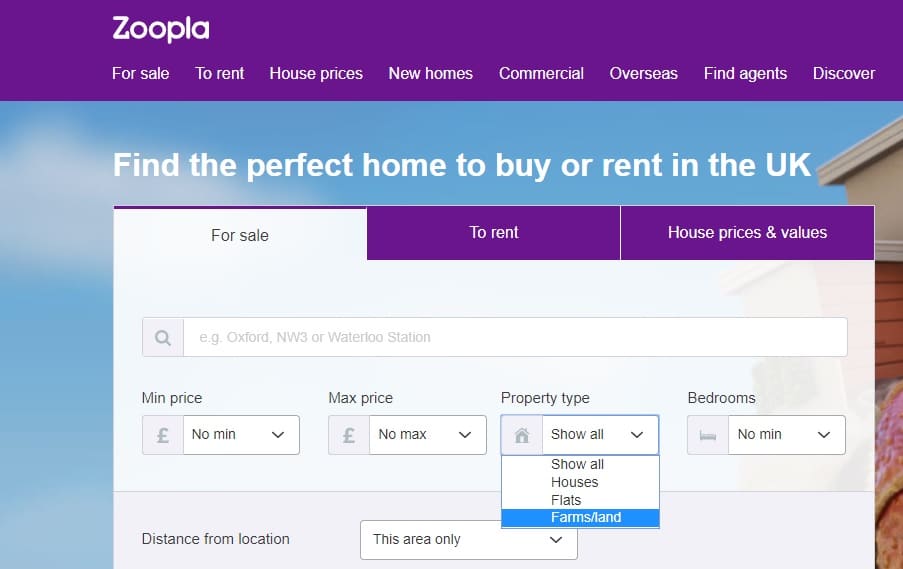

Both of the UK’s property search online portals make it easy to find land opportunities promoted by estate agents.

Use the ‘Property Type’ filter to reveal land offerings.

Zoopla’s filter only allows you to narrow results to ‘farms/land’, so you may need to refine your search more carefully to avoid taking on a few more pigs than you originally planned!

The size of the market is impressive. A quick Zoopla search generates 216 results within 30 miles of Manchester and 406 opportunities in London’s radius.

Direct sales

In rural areas, vendors advertise plots of land for sale on roadside signage. If you have a specific location in mind, keep your eyes peeled for these offers as you drive through the area.

Sometimes these properties are marketed directly by the owner. This opens the doorway to a more efficient process involving fewer middlemen.

That being said, due to the risks I will set out below, I strongly recommend that you should use professional assistance. There are too many legal and regulatory traps that a buyer could unwittingly fall into without the right advice.

Counter-offer a lettings opportunity

A final method you can use to find exclusive land sale opportunities is to make enquiries with agents who are making properties available to rent.

The property owner may be happy to consider a respectful purchase offer even if this selling up wasn’t their original intention.

How to invest in land

Here is an overview of the process to acquire land in the UK.

How to invest in land in 8 steps

1. Source a land plot

Use the four methods above to scan the marketplace and shortlist those opportunities which you feel have investment potential.

2. Make contact with the selling agents to arrange initial visits to the properties

The purpose of an initial visit is to confirm the accuracy of the property listing, rather than to conduct detailed tests.

Visiting the physical location is the only way to protect yourself from fraudulent listings. You can also form an impression of whether the seller is of good character and is serious about selling.

If the seller is being difficult at an early stage, this is a red flag.

3. Hire conveyancing solicitor

A conveyancing solicitor will be your guide through the legal aspects of buying land. They will typically:

- Obtain and review the title deeds to verify the ownership claim,

- Review the boundaries and assess any dispute history,

- Conduct public record searches, e.g. highways search, local search drainage search to identify potential issues,

- Summarise the status of current planning permission,

- Identify any development restrictions or other land charges placed upon the property,

- A good conveyancing solicitor will also search for any planned developments nearby that might impact the land value.

Any of these steps might uncover new information affecting the price, or which might lead you to decide to withdraw from the process entirely.

4. Obtain survey and valuation reports

Solicitors may recommend a surveyor that they have a commercial partnership with, but you are free to choose your own.

Land surveys are not a ‘one size fits all’ solution. Different types of land will carry different risks and therefore a surveyor will be looking for different things.

You could discover the following from a survey:

- Basic information like dimensions and level of elevation

- Environmentally protected species of plants or animals

- Contamination of land from its previous use

- Erosion, instability or other impediments to development

- The fertility and mineral composition of the soil

A surveyor can provide a valuation report of varying levels of detail.

Cheaper options include a desktop valuation (which, as the name suggests, does not involve a physical visit).

For more money, a surveyor would create a plat map, calculate a more accurate valuation figure and highlight the factors which you could use to negotiate a lower price.

5. Agree on a price

You will typically agree a price as a two-party negotiation. But, just like with other types of property, owners looking to sell in a hurry can use an auction house.

6. Arrange finance (if applicable)

Land-only mortgages are available through specialist lenders, private banks, and the occasional high street bank.

Lenders will offer different rates depending on the property location, what you’re intending to do with the land and how you intend to repay the loan.

As a general guide, land mortgages carry higher interest rates and require a higher deposit than residential and buy-to-let mortgages.

This is because land investment is very speculative in nature. Uncertainty about planning permission, title and development costs all add risk from a lenders perspective.

One doesn’t have to look further than Channel 4’s Grand Designs to see examples of lenders losing out when things go wrong.

7. Exchange

A solicitor will draw up a contract for sale. It will contain the key details such as the buyer and seller names, the property address and the price.

You will usually sign the contract on the same day that you pay a downpayment or ‘deposit’.

8. Completion

Completion is the official date when the buyer settles the final balance owed and becomes the owner of the land.

The time between exchange and completion gives the vendor the time to vacate the land.

Depending on the country, the buyer will also pay Stamp Duty Land Tax (England & N Ireland), Land and Buildings Transaction Tax (Scotland), or Land Transaction Tax (Wales) on top of the purchase price.

Thereafter your solicitor can update the Land Registry with the new details.

How to invest in land: the important details

Tenure: Freehold versus Leasehold

Freehold land is owned by the registered owner forever.

Leasehold land only gives temporary enjoyment of the land for a certain period, such as 100 years. If the lease expires, the land returns to the freeholder.

The leasehold might be so lengthy that it will expire long after you do! But this doesn’t mean that it can’t affect your land investment during your lifetime.

As the clock begins to count down, the leasehold deadline can hover over the property value like a dark cloud.

Fearing the loss of value if the lease were to lapse, banks refuse to lend against properties with less than 70 years left.

Fortunately, protections in common law provide leaseholders with a right to extend – at a price. These archaic ‘enfranchisement’ rules evolved in the courts, and critics argue that this area of law is overdue an update. Efforts are underway to lobby parliament to create clearer guidelines by enacting legislation on this issue.

Under the same rules, leaseholders may be able to ‘buy out’ the freehold. This is a separate investment decision in itself, which I won’t go into here.

Otherwise, it’s good sense for leaseholders to extend their leases when possible to ensure that the land retains its maximum value.

Absolute title versus possessory title

In an ideal world, the Land Registry would possess a cohesive map of the UK, divided into separate plots with an owner name against each tract of land.

This is unfortunately not the case. Land records began in the medieval period and the quality of record-keeping reflects this.

Historically, landowners would file records locally. These records sometimes conflicted with neighbouring boundaries. To add to the confusion, several registrars and owners misplaced their title deeds over the centuries.

In 1987 HM Land Registry took charge by compelling all buyers to register their purchased land. This paved the way for them to create a single version of the truth.

This hasn’t resolved the ambiguity because, in all probability, HM Land Registry won’t have registered a property if it hasn’t changed hands in the last thirty years.

Absolute title is when an owner can demonstrate in no uncertain terms that they are the registered owner of a property. This gives absolute and uncontestable ownership rights to the named person on the register.

With possessory title, the registry recognises your claim, but it could be superseded if another person emerges with a stronger claim.

You can upgrade a possessory title to an absolute title if no one challenges your claim for 12 years.

For peace of mind, it is possible to purchase a specialist insurance policy which would payout in the event of a rival claim succeeding. This can be expensive.

Choosing a legal vehicle

There are several ways you could structure a land purchase.

Direct purchase. The land would become your personal asset, and your name would appear on the register.

Corporate purchase. You could form a limited company, and as the sole shareholder, use the company to purchase the land. This company needn’t be registered in the UK. Indeed, many properties in the UK are owned by overseas companies.

Collective purchase. You could invest in an investment trust, partnership or Special Purpose Vehicle (SPV) which pools the funds of multiple investors to purchase land.

There are advantages and drawbacks to each legal structure, the differences are mainly in taxation, personal liability and routes to selling the investment.

Beware of land investment scams

Land investments are not regulated by the Financial Conduct Authority, so investors need to take additional care to avoid falling victim to scams.

Please visit my online investment scam guide to access the UK’s most comprehensive scam checklist to protect yourself.

Planning permission

Planning permission is assigned by the local authority (e.g. council) which controls how a parcel of land can be used. Permission is required for a wide array of uses and changes, so I cannot list all here. Here is a sample:

Full planning consent allows a house to be converted into flats

Permitted Development Rights allow the owner of farmland to build up to three houses on the land.

Advertisement consent permits the erection of billboards

Householder planning consent gives the go-ahead for a new conservatory.

Planning permission is also required to remove buildings, particularly where buildings carry a protected status:

Listed building consent allows the demolition of a listed building

The government gives a maximum statutory timescale of no more than one year for a local authority to reach a decision on planning permission (including appeals). However, due to various reasons, it can take longer.

If there is local opposition to the plan, or environment complications discovered late in the process, this could extend the timeline further and increase the likelihood of rejection.

This is precisely why a piece of land which has planning permission for development is likely to be worth a lot more than one which doesn’t.

For a patient investor, taking the time to follow protocols and obtain permission for a higher-use of the land is well worth doing.

Investors should also ensure that searches have been performed for other local development plans. These could be positive developments (a new Waitrose will probably boost local property prices) or create an eyesore that may reduce the value of the land.

Encumberment

Check for any encumberments attached to the land such as mortgages or other charges by lenders.

A charge is a restriction placed upon a piece of land by a lender as a condition of a loan. A charge prevents a piece of land being sold without the express permission of the lender. This security allows them to lend at lower rates of interest.

If they are not properly discharged, a charge will bind future owners, so they should be on the radar of investors.

Environmental regulations

A variety of environmental issues could emerge which threaten development.

- The land could have protected status, e.g. if it is a protected wetland area.

- A rare and protected species of plant or animal could be living on the land.

- The previous purpose of the land or neighbouring land might have contaminated it. For example, through the misuse of industrial chemicals or landfill.

Environment regulations are numerous and complex. As a result, you may need to hire specialists to assist with your planning permission if any of the concerns above apply.

Council tax

Council tax is an annual tax on land and buildings.

Each local council maintains a very rough valuation estimate for each property in its borough. It will charge the landowner or dweller a tax rate based upon which valuation band the property falls into.

Due to raw land being very affordable compared to housing, you would expect that modest-sized land parcels would attract a low rate of tax.

Uninhabited, vacant land may attract a full exemption. Each council has a different policy, so it’s worth doing your research on the local rules.

Characteristics of the land

These three scenarios are

Situated on a flood plain. Building on an area susceptible to flooding is clearly a danger to dweller and property alike. Planning committees are hesitant to grant permission to build in flood zones as a result.

Even if you could build, it might be uneconomical to do so. Insurers often refuse to insure flood-risk properties, which places a lot of financial risk on dwellers. This severely depresses the value of properties, meaning the return on investment for development will not be attractive.

You can check the long term flood risk of a property here.

Landlocked by neighbours. This is where the land is fully surrounded by other properties. In some cases, a plot may have a ‘right of way’ or ‘right of access’ through another plot, but this is not guaranteed. A land plot without its own access route will have fewer productive uses and will have a much lower market value.

No Road Access. If a parcel of land has footpath access but cannot be accessed by vehicles, this still amounts to a significant restriction on possible uses, and therefore value.

Availability of utilities

Modern homes are connected to many different utility networks:

- Water

- Drainage / sewerage

- Gas

- Electricity

- Telephone landline

- Fibre optic cables

If you expect to exit a land investment by selling to the housebuilding industry, it’s important that the area can be economically serviced by the utility providers.

If a plot of land is too isolated, it will be uneconomical to connect it to the grid of utilities and this will restrict land use.

The availability of utilities can be researched in advance of a land purchase.

The risks of investing in land

Like any investment, investing in land comes with risk.

First of all, use our investment risk appetite questionnaire and time horizon guide to check whether land matches your risk profile.

What could go wrong?

Growth can be modest

The changing demography of the UK underpins land price growth over the long term. However, these gains will not be spread evenly across the country.

There is no shortage of isolated, rural farmland. A 10% increase in the population over the next couple of decades will not lead to skyrocketing prices.

High returns are only experienced in areas with:

- Strong economic growth

- Local development (e.g. a new retail park)

- New transportation facilities

In other words, if the economic prospects of an area see a dramatic surge, land prices will follow.

But otherwise, a passive and unusual piece of land would not generate the type of returns see from investing in shares. Time and money need to be spent on undeveloped land to see reasonable growth.

A slave to the land cycle

The land cycle drives the liquidity of land. Demand for land is high when house builders are happy to spend to increase their land banks.

If you need to sell land during a recession, it’s possible that nobody will make a sensible offer as no new projects are being greenlit.Planning permission is difficult to obtain.

Praying for approval

When considering the purchase price of a piece of land, you need to factor in the risk of permissions being rejected.

Politicians like to promise a more relaxed planning system, but regimes can always change and promises can be broken.

Other times, you can be simply unlucky with committee members and appeals.

An acquaintance of mine once wished to build a lorry driver training centre on an unused brownfield site with access from a fast road. After many rounds of deliberations and numerous surveys provided to the council, it was blocked on the grounds that bicycles would have no access.

This is an all-too-common example of a planning process that can feel bureaucratic, slow and expensive.

Therefore, you should apply a healthy level of scepticism when assessing opportunities. You need to be able to reconcile why the previous owner of raw land didn’t choose to pursue planning permissions themselves.

The truth might be that they decided it wouldn’t be worth the effort after looking into the matter themselves.

Your land questions: answered

I’ve created a series of articles to address other questions that curious land-grabbers might have:

1: Do landowners own the air above their land?

2: Do landowners own the ground beneath their land?

3: Which are the UK’s largest landowners?

Further reading

If you’re interested in picking up a book to really immerse yourself in land investing, we’ve assembled a shortlist which should help you find the right title for you: The best land and forestry investment books.

Inside, we’ve picked our 5 favourite land books and shortlisted several more. To be as helpful as possible, we’ve grouped your options into UK and US orientated – as you may be uninterested in the laws or regulations that only apply in another country.

Course Progress

Learning Summary

How to Invest in Land

Land is a scarce resource with limited supply and growing demand. Its attractiveness is underpinned by historical growth, options for development and clear exit routes.

You can find land for sale on property portals, through land brokers and by looking out for signage.

Search wide for opportunities. Don't begin incurring costs to begin buying a piece of land until you have physically visited the site to assess the veracity of the advertisement.

Team up with a reputable soliticitor and surveyor. The quality of their assessments and their level of skepticism could save you thousands later down the line.

You should immerse yourself and learn as much as possible about the land; its restrictions, title deed history, neighbouring plots, geology, ecology and its access to roads and utilities

A contract for sale should only be drafted by a trained legal expert. Final payment is only made on the day that the seller can assure you have vacant possession.

Keep your expectations realistic - land will require plenty of time and expense (and sometimes luck) to increase in value. Seeking planning permission can be a lengthy process and rejection could be the eventual outcome.

If you approach a land deal with this informed view, and utilise professionals to assist you in this journey, your land investment could become an excellent part of your investment portfolio.

Quiz

Next Article in Course

Before you move on, please leave a comment below to share your thoughts. I respond to all comments.