When comparing the different stocks & shares ISAs available online, the thought must have crossed your mind: “What can placed in a stocks & shares ISA?”. What can you invest in within an ISA wrapper?

Are we to take the name literally and assume that only stocks and shares can be held? This cannot be the case as bonds are certainly welcomed.

You can cease your speculation, as we are about to clearly list the investments that you can hold within a stocks and shares ISA under the ISA rules.

Please note: Just because an investment is legally permitted within the ISA regime, this does not mean that your UK stockbroker will enable you to hold these all in your account. The ISA rules define the legal boundaries of what to invest in within an ISA account, but some ISA providers impose more limitations and restrictions (to simplify the offering and reduce their costs).

Therefore, you should always check the product information of your ISA provider or give them a call to confirm what you can and cannot hold in a particular stocks & shares ISA.

The investments allowed in a stocks & shares ISA

The following asset classes are permitted inside a stocks & shares ISA, and therefore will benefit from the tax-shelter effect of being held inside the ‘tax wrapper’ of an ISA:

Individual assets:

- Cash, including cash held in foreign currencies

- Individual shares in publicly listed companies

- Corporate bonds

- Government bonds

Collective investment schemes:

- Shares in Exchange-Traded Funds (ETFs)

- Shares in publicly listed Investment Trusts, including some of the best Real Estate Investment Trusts (REITs)

- UCITS authorised collective investment vehicles

- Open-Ended Investment Companies (OEICs)

- Unit Trusts

The common theme of all assets permitted inside a stocks & shares ISA is that they must be either publicly traded on a stock or bond exchange, or part of a UCITS-compliant fund.

In practice, the list above means that you can invest in the equities and bonds of virtually any company or government in the world through an ISA. This choice can make investing more difficult. After all, you now have to choose what is the best company to invest in from an enormous range of options. That might be through direct investment, or via an investment into the best funds which in turn invests in those assets. In summary, it’s a broad list – although it’s not complete.

Visit our article about what investments you can’t hold in a stocks & shares ISA to discover the asset classes that you cannot hold within the tax wrapper. Prohibited investments can be held in a standard stockbroker account, online trading platform or another investment platform instead, where proceeds may be taxable.

Which are the best stocks & shares ISAs?

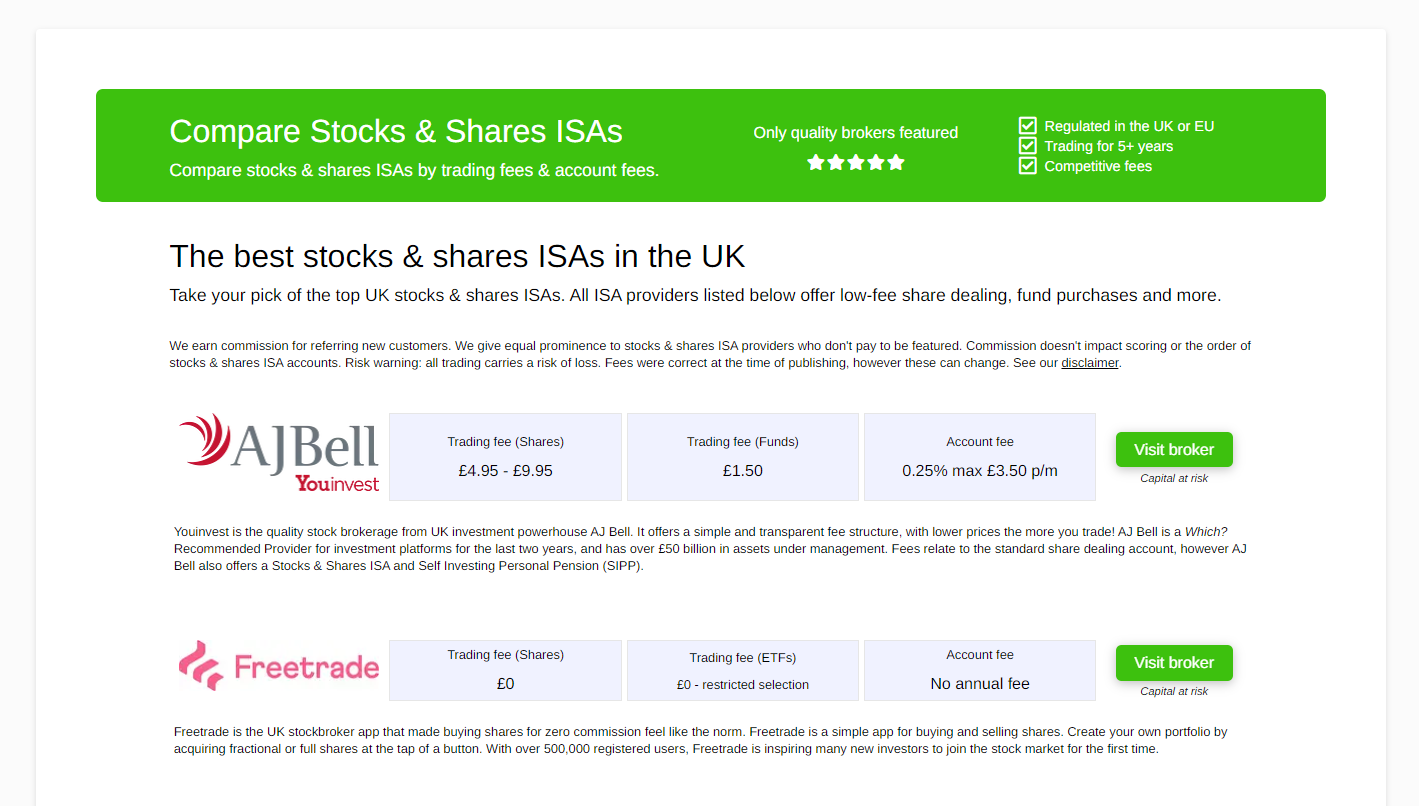

We’ve shortlisted the best of the best stocks & shares ISAs below to help your search:

Large UK trading platform with a flat account fee and a free trade every month. Cheapest for investors with big pots.

The UK’s no. 1 investment platform for private investors. Boasting over £135bn in assets under administration and over 1.5m active clients. Best for funds.

Youinvest stocks & shares ISA offers lower prices the more you trade! Which? 'Recommended Provider' for last 3 years.

Buy and sell funds at nil cost with Fidelity International, plus simple £10 trading fees for stocks & shares and ETFs.

Capital is at risk

Please also see our Hargreaves Lansdown review, our AJ Bell review and interactive investor review.

Use your imagination

With the varied menu of investment options, its easy to picture 10 dramatically different portfolios all within stocks & shares ISA rules. Here is a selection of the approaches which are possible:

The value ISA

A portfolio built around the value investing strategy, including deep value funds and individual share picks which the investors feels are undervalued.

The growth ISA

A portfolio following the growth investing strategy, with the help of the best growth investing books. This would consist of a basket of tech stocks and corporate bonds to help balance out the risk.

The cautious ISA

A cautious portfolio designed for a low risk tolerance, which includes cash, government bonds and corporate bonds, with a 20% allocation to equities to enhance the return.

The equity ISA

A pure play on equities, using cheap equity ETFs to get 100% exposure to the growth in worldwide companies from a variety of sectors.

The dividend ISA

An ISA with individual shares which pay a high dividend yield. This ISA could produce a tax-free income in retirement. By applying the dividend growth investing strategy, the investor could seek an increasing income stream which keeps pace with inflation.

Books to discover more about what investments you can hold in a stocks & shares ISA

We’ve created book review pages which summarise the best money book titles in each genre which can help you learn more about all the concepts introduced above. Please check them out to see the greatest works by smart money & investment writers.

Everything you need to know about stocks & shares ISAs

- What is a stocks & shares ISA?

- What investments can be held in a stocks & shares ISA?

- How to become a stocks & shares ISA millionaire

- The history of stocks & shares ISAs

- Who can open a stocks & shares ISA?

- What is the minimum amount needed to open a stocks & shares ISA?

- Are stocks & shares ISAs only available in the UK?

- Full list of stocks & shares ISA providers

- How risky are stocks & shares ISAs?

- What fees do stocks & shares ISA accounts charge?

- What is the current stocks & shares ISA allowance?

- Are stocks & shares ISAs tax free?

- Do you need to disclose income and gains in stocks & shares ISA on your tax return?

- What happens to a stocks & shares ISA when I die?

- Stockbroker reviews (UK)