Cashier’s checks are helpful to pay large costs; you may want to issue one when investing in an estate, buying a vehicle, or paying for a mortgage. Whatever the case, cashier’s checks are easily accessible even if there are insufficient funds in your bank account. In the UK, a cashier’s check is also known as a banker’s draft.

It is easy to ask your bank to issue a cashier’s check, but the hard part comes when it offers only its customers the facility. And when you don’t have a bank account, getting a cashier’s check can be hectic. However, the good thing is that it is not entirely impossible.

So, let’s get right into the topic as the following guide covers everything about a cashier’s check, its process, and how and where to get a cashier’s check without a bank account. More modern payment systems may be steadily being adopted by the younger population but cashier’s checks or banker’s drafts are still demanded by some landlords when putting down a deposit for a property rental.

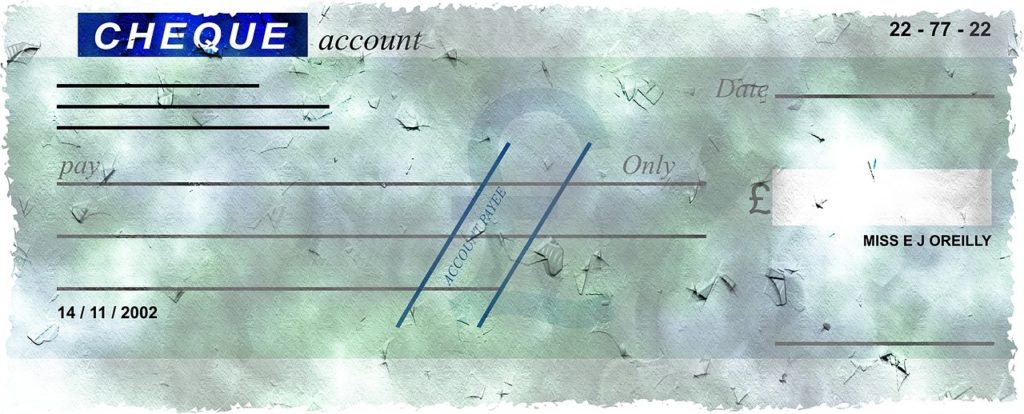

What is a cashier’s check?

A cashier’s check is a check that you withdraw from your checking account. And in case you are wondering, a checking account is similar to a current account except that you can withdraw a cashier’s check – a valuable alternative to personal checks or cash.

If paying in cash isn’t an option, or you can’t get a personal check from your bank due to insufficient funds, what you can do is ask your bank to give you a cashier’s check. Even if you don’t have enough money in your bank account, a cashier’s check will not bounce as the money is provided by the bank and not from the person’s account.

How does a cashier’s check work?

You can simply ask your bank account to give you a cashier’s check provided that you have enough money in your account. Typically, the banks charge a small amount as fees for issuing a cashier’s check.

Once you have made the request, the bank will first ensure you have a sufficient amount in your account. Then, the bank will provide you with the cashier’s check and get the authority to move funds from your account to the bank’s account.

Moreover, you can also benefit from the technology and ask the bank to deliver the cashier’s check to your address. However, bear in mind that along with the bank’s fee to issue a cashier’s check, you’ll also have to pay the delivery fee.

Is it possible to get a cashier’s check without opening a bank account?

Whether or not you have sufficient funds in your bank, you can still issue a cashier’s check. However, the problem comes when you want to get a cashier’s check without a bank account. As some banks only offer the facility of a cashier’s check to their customers, opening a bank account may be your only solution to avail of the option.

As the best banking books will highlight, there are other options to get a cashier’s check, but it would require some research and effort. If you are not associated with a bank, you would have to find the banks that sell a cashier’s check to their non-customers. As you don’t have a bank account to pay for the funds, you would have to pay the bank for the cashier’s check in cash.

Where to get a cashier’s check without a bank account?

As said previously, you can ask a bank if they can provide you with a cashier’s check in exchange for a price. However, there are also other ways to get a cashier’s check without a bank account, such as:

1. Banks

Either the bank would agree to sell you a cashier’s check or ask you to open a bank account. In the former case, you would hand over the fund in cash, while the latter would require you to deposit enough funds in your account once you open it.

Also, before opening an account, it would be best not to forget to ask the bank’s policies regarding cashier’s checks, as sometimes, the money you deposit may not be available instantly for a cashier’s check.

2. Credit Unions

The first option to get a cashier’s check when you don’t have a bank account is to contact banks. But if by any means banks are not available for a cashier’s check, you can approach credit unions.

The process is similar to banks, and you’d have to ensure the specific credit union you are looking for doesn’t limit the cashier’s check to their customers only. Otherwise, seek a representative, pay in cash, and you can get your cashier’s check without a bank account.

You cannot have a bank account and still get a cashier’s check, but if the case is another way around where you want to cash the check but don’t have a bank account, you can follow the same process.

Bank of America, for instance, is one of the famous banks in America which allows non-customers to cash a check for a fee. And if you still have doubts, feel free to go through this guide to know everything about checks: https://application-gov.us/how-to-cash-a-50000-check/

Other reading material

For other money management tips and books about saving money, please check out our extensive shortlist of the best personal finance books.